SOFTWARE VALUATIONS INSIGHTS | Q1 2025

Our quarterly Software Valuations Insights Report is a vital resource for SaaS founders, CEOs, and Investors, offering comprehensive analysis and insights into the valuation of public software companies

The report is divided into ten benchmark segments, providing a detailed examination of the performance and outlook across various software verticals. It delivers essential data and trends, enabling informed decision-making in the rapidly evolving software industry.

Key takeaways from the Q1 software valuations insight update include:

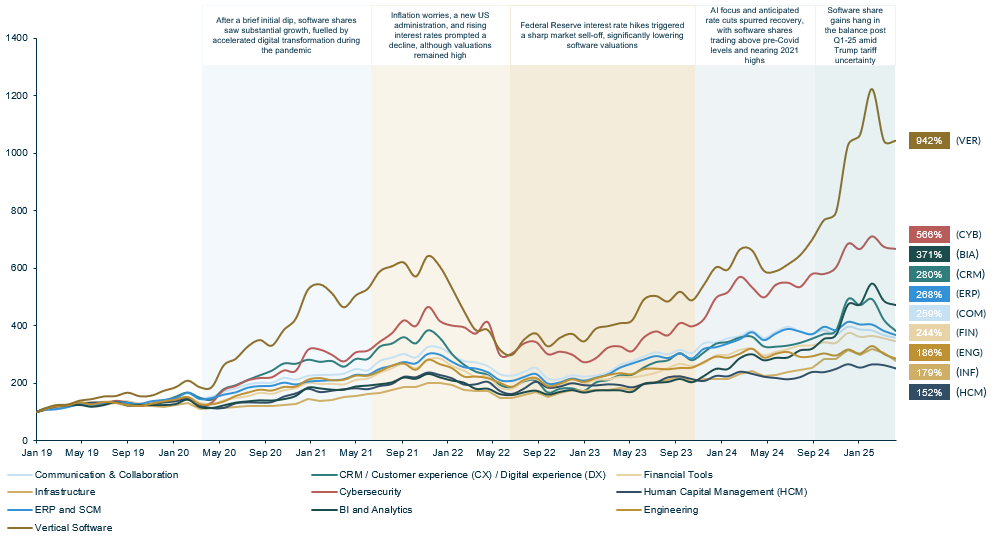

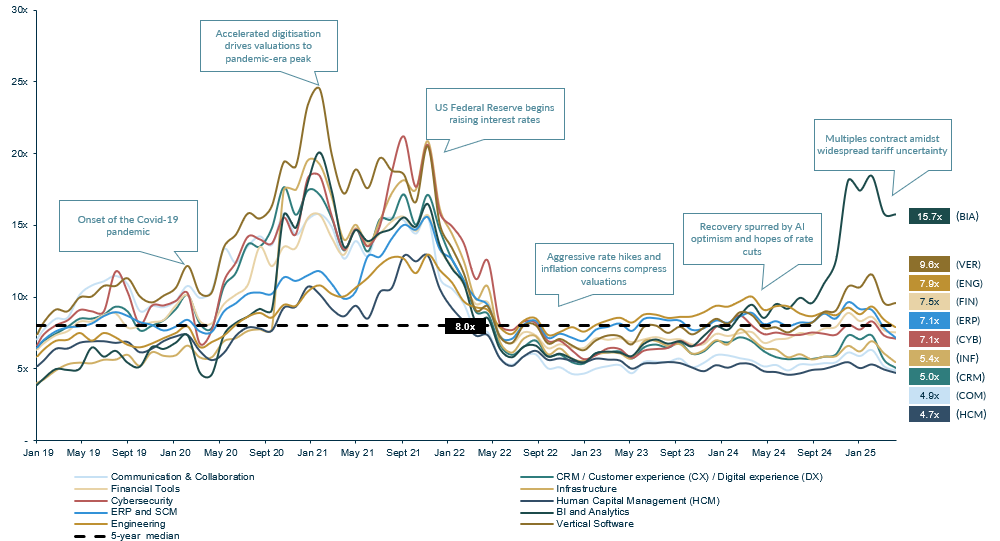

- Software valuations endured a turbulent Q1 2025. While early gains were driven by sustained AI focus and market optimism following Trump’s inauguration anticipating new highs, these highs faltered significantly due to escalating tariff concerns and implementation, which increased volatility and weakened sentiment towards the end of Q1 and into Q2

- Cybersecurity M&A activity is intensely driven by escalating, sophisticated cyber threats, increasingly AI-powered, alongside stricter global regulations (like NIS2/DORA) which compel organisations to urgently enhance their security capabilities and compliance posture

- Companies view M&A as the fastest route to acquire advanced capabilities, achieve integrated security platforms to combat tool sprawl, and address threat complexity, reflected in sustained high deal volumes through late 2024 and early 2025

The cybersecurity M&A market remains highly active, fuelled by a heightened threat landscape, pressing regulatory demands, and transformative AI advancements. This drives record M&A activity as organisations pursue strategic consolidation to gain integrated solutions and expertise. However, the sector now faces emerging economic uncertainty following recent tariff actions, potentially impacting future investment and deal flow despite the fundamental security needs.

Public market software valuations turbulent amidst tariffs

Significant turbulence characterised public software valuations in Q1 2025. Initial optimism, spurred by ongoing AI focus and expectations of market highs following Trump’s inauguration, was sharply curtailed by the disruptive impact of tariff implementation (’tariffication’). This sparked considerable market volatility and dampened sentiment as the quarter concluded.

Enterprises move from tool sprawl to vendor consolidation

Initially, cybersecurity involved a fragmented ’best-of-breed’ approach with numerous vendors, often resulting in unused ’shelfware’. Today, driven by cloud-native adoption, enterprises are strategically consolidating security vendors. Gartner predicts 70% will consolidate vendors by 2025 (up from 29% in 2020).

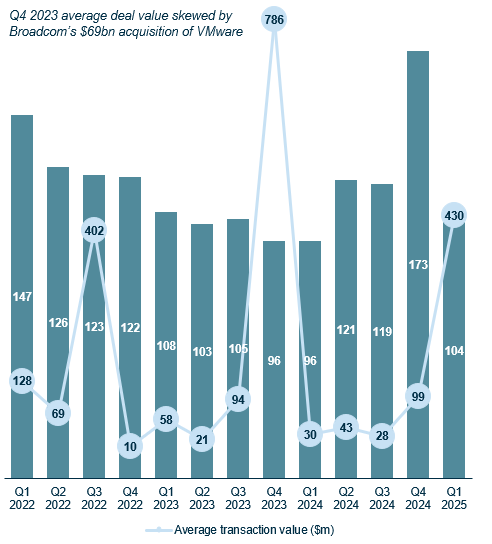

Cybersecurity M&A volume remains high

Cybersecurity M&A deal activity surged dramatically in 2021 and has remained at historically elevated levels since. Average quarterly volumes from 2021-2024 significantly surpass pre-pandemic figures (2017-2020), driven by escalating threats and strategic consolidation, with strong momentum continuing into early 2025.

Escalating Threats and Tighter Regulations Drive increased Cybersecurity Deal Activity

- Cybersecurity M&A is accelerating, driven by strategic acquirers and private equity addressing urgent market needs

- Record M&A volume was set in Q4 2024, with momentum continuing into 2025 (104 deals YTD by quarter end, following 500+ in 2024)

- M&A is being driven by escalating cyber threats (including AI-driven attacks, reflected in an ~80% YoY rise in weekly attacks reported in Q4 2024) and stricter regulations

- Boards view acquisitions as the most rapid method to close security capability gaps against sophisticated attacks like advanced ransomware and data theft

- Consolidation offers a direct path to integrated defences, combating the complexity of advanced threats (AI breaches, critical misconfiguration)

- Enterprises struggle with tool sprawl (averaging ~45 security tools), increasing demand for cohesive, unified platforms covering detection, response, and prevention

- Brisk M&A activity aims to address threat complexity, deliver end-to-end coverage, and leverage cybersecurity’s resilient revenue models

Average weekly cyber attacks per organisation (2021-2024)

Six market forces reshaping cybersecurity and driving M&A

Escalating cyber threats

- Significant YoY surge in attacks drives defence demand

- AI-enhanced attacks underscore need for integrated platforms

AI-powered & sophisticated threats

- AI increasingly used by attackers for automation (phishing, exploits)

- 17% of attacks GenAI-based by 2027, shaping ’25 budgets

Regulatory and compliance pressure

- Mandates like EU’s NIS2 & DORA fuel compliance-driven M&A

- Regulations push niche acquisitions for critical infrastructure protection

Cloud complexity & vulnerabilities

- Hybrid cloud fuels risks like misconfigurations (~12% of attacks), increasing breach potential

- Rising cloud attacks drive zero-trust adoption

Enterprise security spending boom

- Substantial budget growth ($184bn ’24 -> $212bn ’25)

- Spending priorities: Cloud security, AI defences, integrated platforms

Vendor stack simplification

- 70% of organisations seek to consolidate vendors by 2025

- Comprehensive solutions offer end-to-end coverage and less operational overhead

Sources: D.A Davidson MCF International research, Pitchbook, Gartner, Checkpoint, CrowdStrike

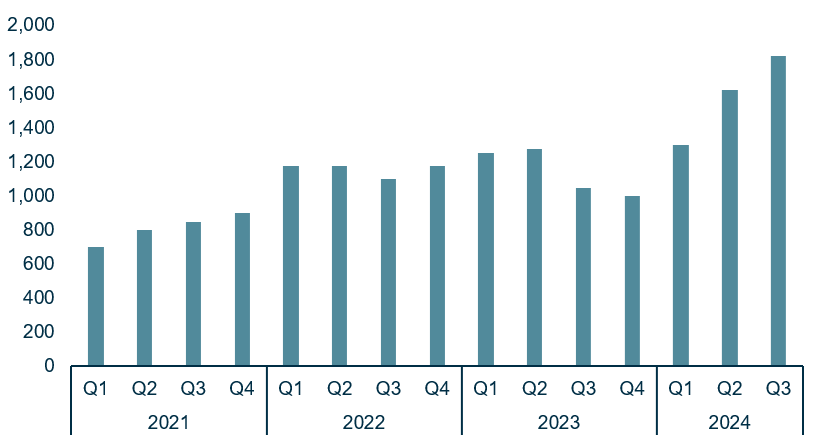

Cybersecurity M&A Deal Volume continues to Exceed Pre-2021 Benchmarks

Cybersecurity Quarterly Deal Volume

Sources: D.A Davidson MCF International research, Pitchbook

Quarterly Insights on Public Software Valuations

Share Price Index – Update Post Liberation Day

Markets experience extreme volatility following Trump’s ‘Yo-Yo’ tariff announcements post Q1 end

EV/NTM Revenue – Update Post Liberation Day

Similarly, EV/NTM multiples tracked valuation volatility driven by tariff policies

Source: S&P CapIQ as of April 9, 2025

Download

The full report including public comparables by software verticals can be downloaded at the top of the page.

Contact us

If you have any questions about the report, please contact one of our team. You can find more information about our tech capabilities here.

Previous Software Reports

Software Valuation Insights | Q4 2024

Software Valuation Insights | Q3 2024