Aerospace, Defense & Government Services | Industry Update Fall 25

“Herd” on the Street

Through the first three quarters of 2025, the D.A. Davidson | MCF International AD&GS team attended over twenty industry events and engaged in numerous conversations with key industry constituents across strategic and private equity acquirors. The following represents a summary of

Davidson’s Bison “Herd” on the street.

Aerospace

New trade deal restores zero-for-zero aerospace tariffs

- In late July 2025, the Trump administration reached a trade agreement with the European Union (“EU”) which restored zero-for-zero tariffs for all aircraft and component parts

–Industry participants welcomed the reciprocal policy, stating it would lead to more jobs, allow for further innovation in aerospace, and grow the U.S. aerospace trade surplus

GE Aerospace reaches five-year labor agreement to end three-week strike

- GE Aerospace ended a three-week strike of more than 600 United Auto Workers union employees at its Ohio and Kentucky distribution facilities

–The tentative deal includes a base wage increase ranging from 3% to 5% through 2029, along with ~$3,500 in cash payments per employee to help offset rising healthcare costs

Global airlines make large Boeing jet orders

- In late September 2025, Turkish Airlines verbally committed to order 75 787s and completed negotiations to buy 150 737 MAX aircraft

- In early September 2025, Canada’s WestJet announced an agreement with Boeing for the purchase of 60 737-10 MAX aircraft, with options for an additional 25. The order also included seven 787-9 widebody Dreamliners with options for four more

- In late August 2025, Korean Air announced a $50B order for 103 Boeing airplanes (includes a mix of 787s, 777s, and 737s) with GE Aerospace engines

- The Turkish Airlines and Korean Air purchases coincided with meetings between President Trump and the respective president of each airline’s country

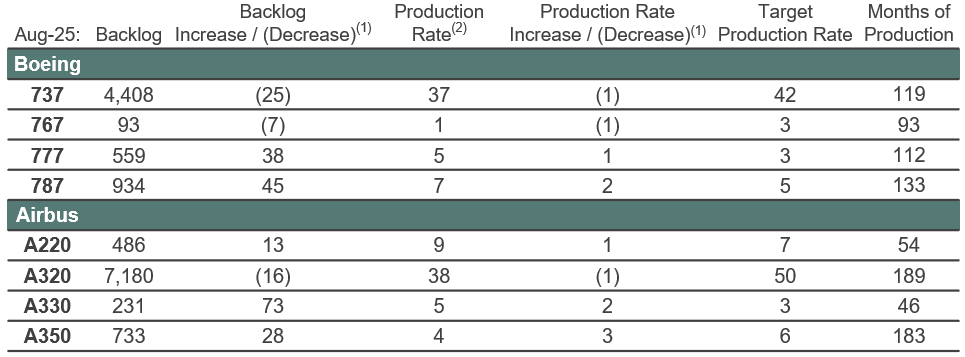

Boeing and Airbus backlogs grow amid continued production struggles

- Despite signs of gradual improvement in the aerospace supply chain, Boeing and Airbus continue to face production ramp-up challenges, driving further growth in order backlogs

Boeing and Airbus August 2025 Backlogs and Production Rates

Global Defense

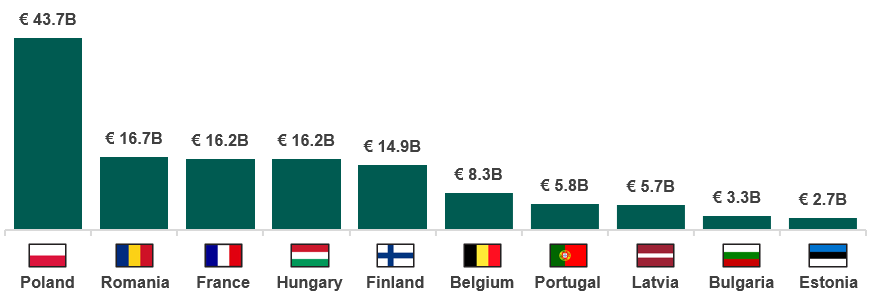

EU launches Security Action for Europe (“SAFE”) initiative to strengthen defense

- The EU’s SAFE initiative is a €150 billion EU financial instrument designed to provide long-maturity, low-cost loans to Member States to accelerate urgent and large-scale investments in defense capabilities including missiles, drones, and cyber defense

–SAFE marks a major step toward European defense autonomy, enabling rapid, coordinated investment in military capabilities amid growing geopolitical threats

Tentative SAFE Contribution per Member State by 2030

Russian drone strikes underscore global shift to low-cost, high-impact warfare

- Ukraine’s air force reported that Russia launched over 5,600 drones into the country in September 2025, a ~40% increase compared to August 2025

–While Ukraine downed or suppressed nearly 90% of the Russian drones, the significant cost asymmetry remains unsolved and top of mind for military leaders across the world - The U.S. military launched its “Unleashing U.S. Military Drone Dominance” initiative in July 2025, aiming to boost American drone manufacturing and equip warfighters with low-cost, domestically produced drones to counter growing threats

–“We will power a technological leapfrog, arming our combat units with a variety of low-cost drones made by America’s world-leading engineers and [artificial intelligence] experts” – Pete Hegseth (U.S. Secretary of Defense), Defense Memo (7/11/2025)

Australia boosts naval power with undersea drones

- Australia is investing $11B in a fleet of autonomous undersea drones developed by U.S. defense firm Anduril

–This move signals a strategic shift toward AI-driven warfare, continued reliance on U.S. defense technology, and reinforces allied deterrence in the Indo-Pacific

Congress introduces Quad Space Act to bolster orbital cooperation

- The Quad Space Act, introduced in the U.S. House and Senate, seeks to deepen in-orbit cooperation among Quad nations consisting of Australia, India, Japan, and the U.S. by promoting joint efforts in space situational awareness, industrial policy, and best practices –This legislation aims to strengthen allied space capabilities and maintain strategic advantage over China in the emerging global space race

2025 Defense and Security Equipment International (“DSEI”) takeaways (for the full version click here)

The D.A. Davidson | MCF Corporate Finance team attended the 2025 Defense and Security Equipment International Exhibition in London on September 9-12th. Despite the London Tube strike and anti-war protestors at the entrance gates, there was record attendance at DSEI

Bolstered by the surge in defense spending across Europe (with many references to a UK and European “defense dividend”), the show floor and number of exhibitors was considerably larger than in 2023 – over 60,000 visitors (from more than 70 countries) attended the exhibition and over 1,700 exhibitors showcased capabilities across land, air, naval, cyber, and space domains

- Eastern Europe faces new escalation: The tense geopolitical climate is still very front and center, as news broke during the conference that Russian attack drones penetrated Polish airspace requiring Poland and Dutch fighters to engage

- Drones dominate defense tech: Drones and counter-drones were pervasive throughout the exhibit hall – a clear signal about the future of warfare and lessons learned from the Ukraine battlefield and Middle East conflicts, where drone warfare continues to evolve from single-drone use to swarms and multi-drone operations

–Shift toward scalable defense innovation: Big weapon systems are being questioned, as priorities shift to more technology-enabled, cost-effective solutions (directed energy weapons, unmanned aerial systems (“UAS”), counter-UAS technology, cyber, quantum computing, and AI / Autonomy) that can be mass produced and / or force multipliers

–Buyers prioritize electronic warfare: Electronic warfare (“EW”) continues to be the #1 priority atop almost every buyer’s shopping list

–Europe accelerates defense independence: Tariff challenges and uncertainty with U.S. posture with NATO is driving European militaries to accelerate domestic sources for rearmament; meanwhile, the delegation of U.S. defense companies and investors attending was noticeably larger as they target opportunities to participate in this new wave of European defense spending

–Supply chain strains European defense output: European manufacturers are facing challenges to increase their production capacity given persistent supply chain issues. Suppliers are looking to make procurement more agile by securing cross border cooperations and targeting opportunities for vertical integration

–Defense startups face funding friction: Defense tech darlings are hoping to turn market buzz into landmark program awards, but face challenges to generate meaningful sales due to procurement bureaucracy – how patient will investors be if there are continued delays in program funding or their solutions are not adopted?

–Naval defense gains strategic focus: Maritime defense was a domain that received even more attention than compared to prior years at DSEI, as the confluence between military interests and maritime supply chains highlights the importance of naval defense to protect major maritime trade routes, civilian ports of global importance, and sensitive energy infrastructure (e.g., oil rigs and undersea pipelines)

Germany ramps up defense spending to meet NATO targets

After years of underinvestment, Germany is leveraging both public and private funding to accelerate its defense build-up, aligning with NATO’s 5% GDP target. This shift is transforming its industrial base and promoting European cooperation in defense modernization

Download

The full report, including Global, US Defense, Government Services and Space Market update as well as global M&A activity, debt and equity capital markets activity, can be downloaded at the top of the page.

Contact us

If you have any questions about the report, don’t hesitate to get in touch with one of our team.

Get in touch