Food, Beverage & Agriculture | M&A Industry Update | Q3 2025

M&A activity holds firm amid challenging conditions in Q3 2025

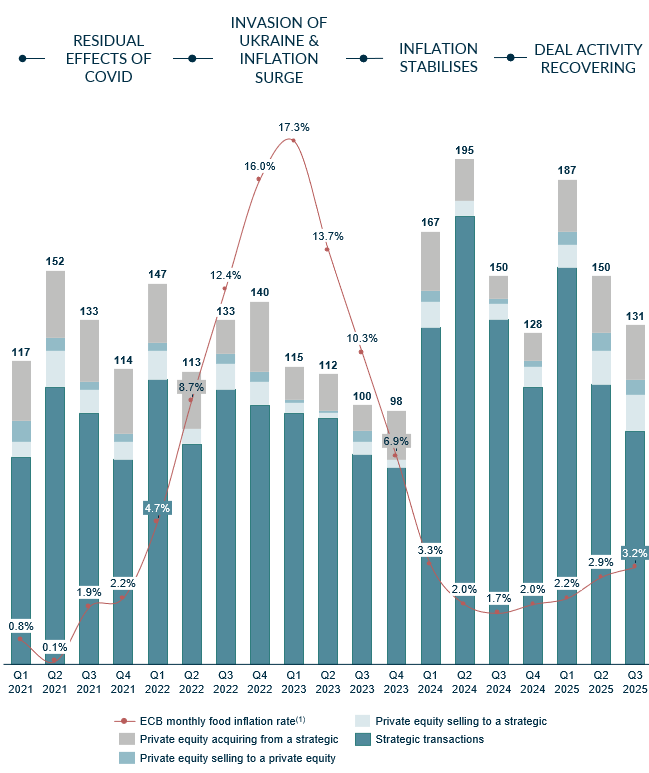

European Food, Beverage, and Agriculture M&A remained robust in Q3 2025, yet the summer did bring a seasonal easing, with overall transaction levels down 12.6% on Q2 2025 volumes. The quarter mirrored the first half of the year in tracking just below 2024 quarterly levels. Acquirers focused on resilient, high-quality assets with brand equity, margin visibility, ESG strength, and supply-chain resilience. Private equity and strategics alike pursued carve-outs, bolt-ons, and consolidation across ingredients, beverages, snacks, and plant-based proteins.

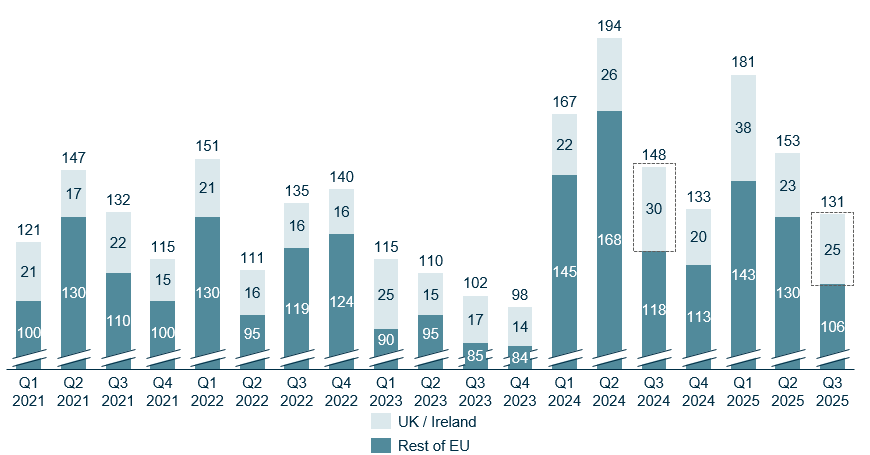

In the UK & Ireland, mid-market dynamics reflected broader European trends, yet overall deal volumes rose 8.7% on Q2 2025, underscoring the region’s resilience and its position as an increasingly attractive hub for FB&A M&A activity in Europe.

In public markets, the European FB&A IPO pipeline is reawakening, led by New Princes Group’s planned UK listing and Magnum’s spin-out from Unilever.

Transaction multiples have softened slightly from Q2 to Q3 2025, except across the Distributor and Food segments which posted small gains

Three key focus areas as we move towards the end of 2025

1. Multinational food & beverage giants continue to reshape portfolios: Q3 saw continued portfolio tidy-up with divestment of non-core assets to focus on high-growth platforms. Kraft Heinz sold its Italian baby and specialty food unit to New Princes Group, while Nestlé is rumoured to be reviewing parts of its

Vitamins, Minerals & Supplements portfolio (incl.The Bountiful Company). The common thread: rationalise slower or sub-scale categories, recycle proceeds, and double-down on advantaged brands

2. Bakery & convenience momentum continues: After months of speculation, Kingsmill owner ABF agreed to acquire Hovis Group from Endless; Lantmännen Unibake expanded in savoury with Boboli Benelux, strengthening its position in Europe’s bake-off market. Bakery/convenience assets also drew buyers seeking direct-to-consumer reach and “ready-to-eat” capabilities. Finsbury Food Group took a 70% stake in Lola’s Cupcakes marking its first step into D2C. In convenience meals, Premier Foods agreed to acquire Merchant Gourmet to add a premium and healthy brand to its growth model

3. Ingredients and value chain Integration: M&A in upstream and formulation segments continued to play a strategic role as buyers sought to control key inputs, guard against margin erosion, and capture innovation. Notable transactions in the space include THG’s disposal of Claremont Ingredients and more recently the announcement of Natara Global’s agreement to purchase Treatt

Engaging in future opportunities

As we move through Q4, sentiment across European FB&A M&A appears to be improving despite ongoing political and economic uncertainty. Advisors report rising activity as preparations and sale processes accelerate for launches expected in Q4 2025 and Q1 2026.

Over the Pond – Q3 2025 Review

The deal market has continued to thaw

Q3 saw a gradual loosening of purse strings as investors began to have more success getting through the investment committee gauntlet and the default “no’s” that started the year have slowly turned into FOMO-driven “Yes’”. M&A pitch activity has increased significantly, and this time with the expectation to bring assets to market right away rather than taking a “wait and see” approach. We have seen high interest in recent processes from both strategic and financial buyers as a higher quality of assets has provided much needed and refreshing relief from the sub-par deal flow buyers have been fatigued with in recent years. Confidence in public markets has also started to return as seen in successful secondary offerings of Nature’s Sunshine (NASDAQ:NATR) and Black Rifle Coffee Company (NYSE:BRCC).

Tariff impact

Major uncertainty and concern around the impacts of tariffs have been pushed to the back of minds as consumers continue going about their day-to-day without knowing how or when this will all impact them. Not to say the uncertainty has faded, but a track record of real-world impacts not being as bad as headlines initially suggest has eased some concerns about how much tariffs will impact supply chains and consumer prices. Food and Beverage is typically more insulated from global supply chain disruptions than other sectors are, which has also helped provide relative confidence that this is a safe space to invest.

Interest rates still elevated, but pointing toward additional cuts

U.S. consumers continue to The U.S. Federal Reserve has cautiously begun to cut rates and have signalled that cuts will continue, but we have not seen significant changes in lender pricing or terms yet. Buyers may be more comfortable stretching a bit on valuation as asset quality improves but sustained higher interest rates have prevented the market from running away and becoming overheated.

Consumer continue to spend in the perimeter of the store

Along with the continued tailwinds around low-sugar, high-protein snacking trends, we have seen consumers spend more of their time and money shopping in the perimeter of the grocery store where fresher items with shorter shelf lives and less additives are sold. Bakery is an area that we track monthly data closely and have seen consistent declines in consumer spending on the packaged baked goods in the centre-store aisles, with exception of cookies.

Looking ahead

Sentiment feels positive, and investment bankers are busy as the volume of deals heats up into Q4. Barring a larger recession or major global news event, we expect to see additional quality businesses brought to market and investors continue to lean in on valuations as long as the consumer continues to spend and interest rate conditions become more friendly.

Snapshot of European Food, Beverage & Agriculture M&A deal activity

Deal volumes are tracking just below 2024 record levels

Number of announced acquisitions of European-based FB&A companies (deal value below USD 500m) & food inflation index rate from ECB

Note: 1) Rate calculated as the median rate Source: Mergermarket, European Central Bank

Food, Beverage & Agriculture M&A deal activity by market

UK & Ireland deal activity in Q3 2025 exceeds Q2 2025 yet falls below Q3 2024

Number of announced acquisitions of European-based FB&A companies (deal value below USD 500m), divided by region of target company

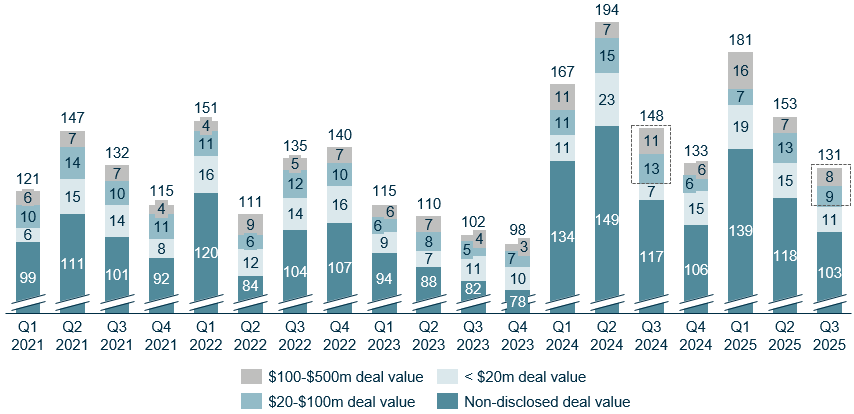

Mid-market deal activity in Q3 2025 fell short of Q3 2024 with 17 deals between $20 and $500 (disclosed deal value)

Number of announced acquisitions of European-based FB&A companies (deal value below USD 500m), divided by deal size

Source: Mergermarket

Download

The full report, including public company valuations & operating metrics as well as public comparables by subsector, can be downloaded at the top of the page.

Contact us

If you have any questions about the report, don’t hesitate to get in touch with one of our team. You can find more information about our consumer capabilities here.

Previous Food, Beverage & Agriculture Reports

Food, Beverage & Agriculture | M&A Industry Update | Q2 2025

Food, Beverage & Agriculture – M&A Industry Update – Q1 2025

Get in touch