Industrial Automation – Industry Update Q3 2025

Industrial Automation benefits from digital transformation, reshoring, and artificial intelligence

Industrial automation is benefiting from powerful tailwinds as manufacturers accelerate digital transformation and invest in next-generation infrastructure. Persistent labor challenges, growing demand for operational efficiency, and increasing reshoring investments are reshaping production and logistics environments. At the same time, advancements in AI and increased demand for data-driven systems are fueling a broader shift toward smart, automated operations.

,

Macroeconomic Update

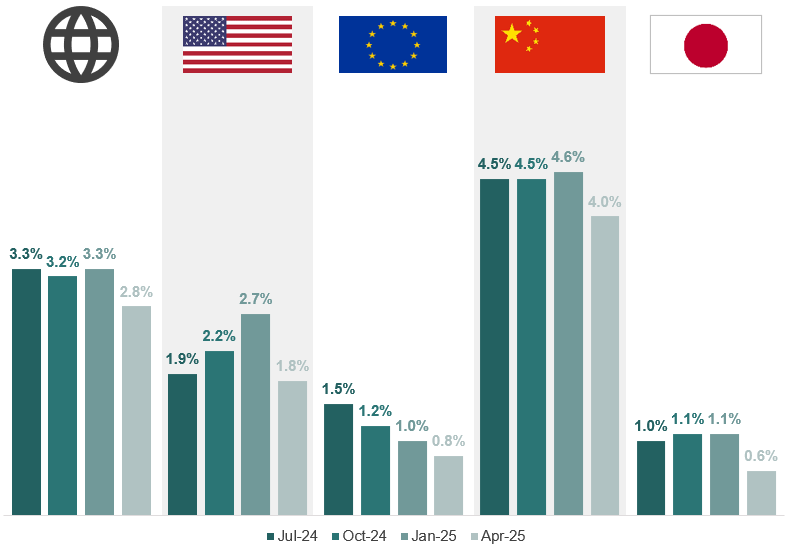

Global GDP outlook at 2.8% driven by tariffs and policy uncertainty with the U.S. showing the sharpest drop

- Global real GDP growth outlook for 2025 slipped in the most recent quarter after remaining relatively stable; current outlook is 2.8% globally, which is below the 2000 – 2019 average of 3.7%

- Lower growth outlook largely driven by concerns with tariffs and high levels of policy uncertainty; U.S. saw the largest reduction in outlook among major economies, declining by ~1%

- Tariffs have created an environment of uncertainty over the past couple months; market is closely monitoring tariff headlines as they change in real time

- While the long-term implications are unclear given the overall scope and frequency of policy changes, tariffs will likely impact economic sentiment, inflation expectations, and interest rates globally in the near-term (impact not fully reflected in all indicators included herein given recency)

Real GDP Growth Forecast (2025)

Source: D.A. Davidson MCF International Investment Banking, International Monetary Fund (“IMF”), and OECD

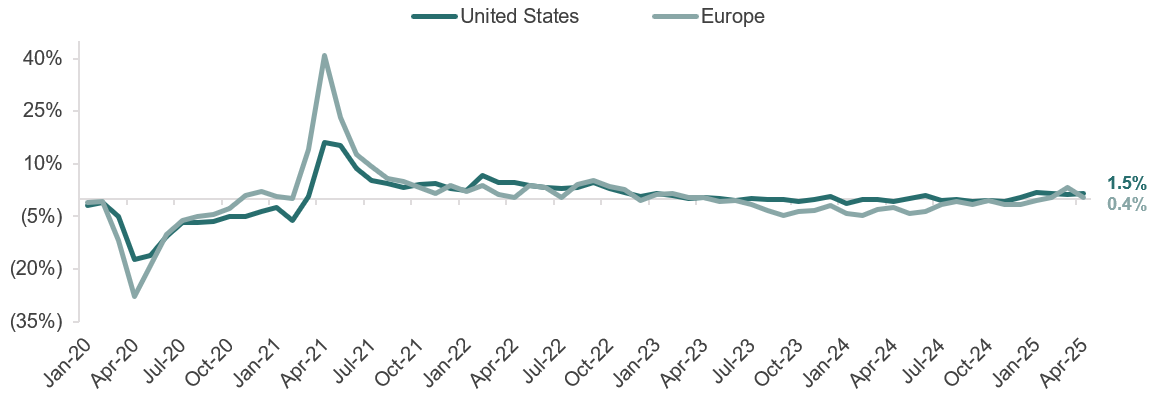

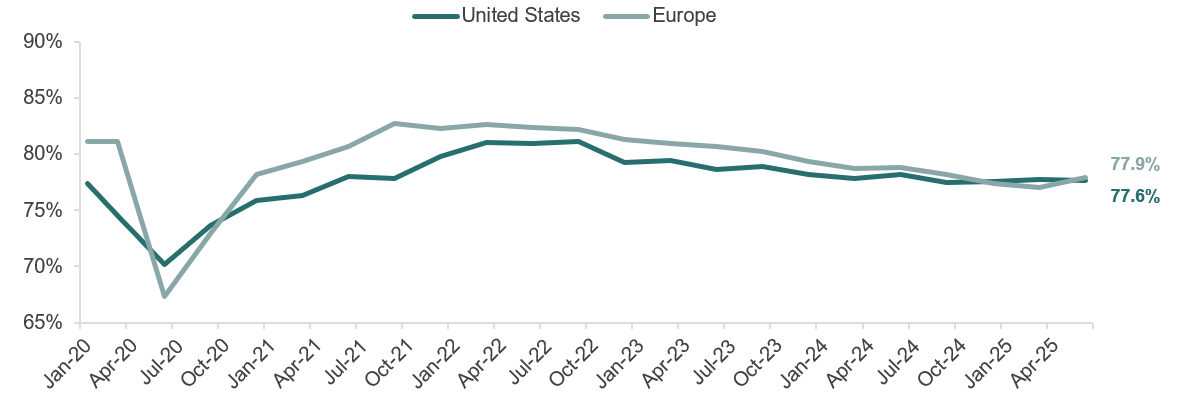

Industrial & Manufacturing performance indicators

- Industrial production in both the U.S. and Europe has turned modestly positive in 2025 after a relatively flat 2023 and 2024, as easing inflation, improved supply chain reliability, and gradual demand normalization have supported a mild recovery in output

- Capacity utilization rates have remained stable since mid-2022, with U.S. and European manufacturers continuing to operate at stable but slightly declining levels, reflecting cautious capacity deployment amid soft new order intake and limited capital expansion

- Recent trends point to a manufacturing sector that has largely stabilized following post-pandemic disruptions, but one that remains demand-constrained, with firms prioritizing cost control and throughput efficiency over incremental growth in response to subdued order activity and uncertain visibility into near-term end markets

Industrial Production Index (YoY Growth)

Capacity Utilization Index

Source: Federal Reserve Bank of St. Louis, European Commission Eurostat

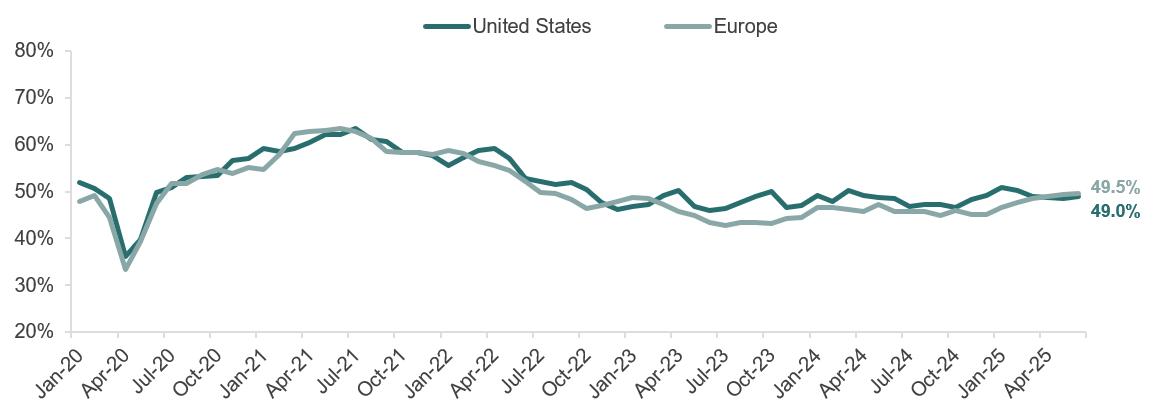

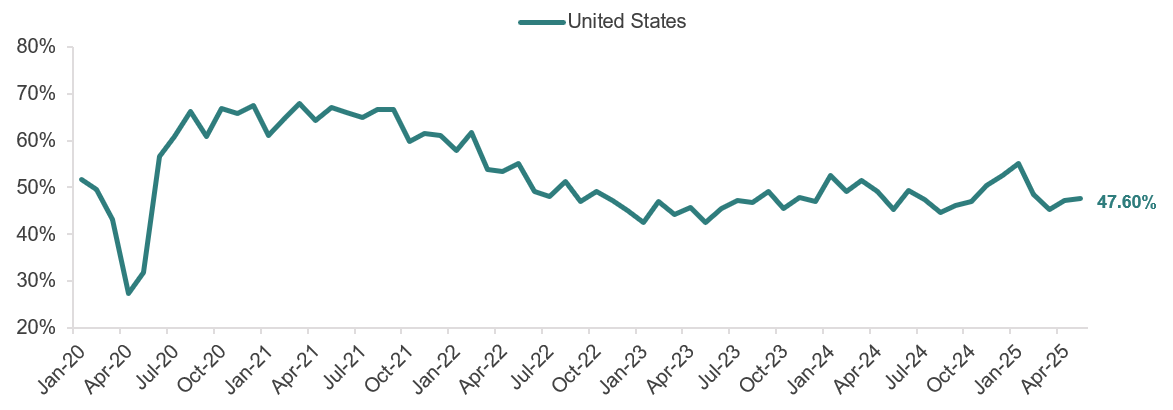

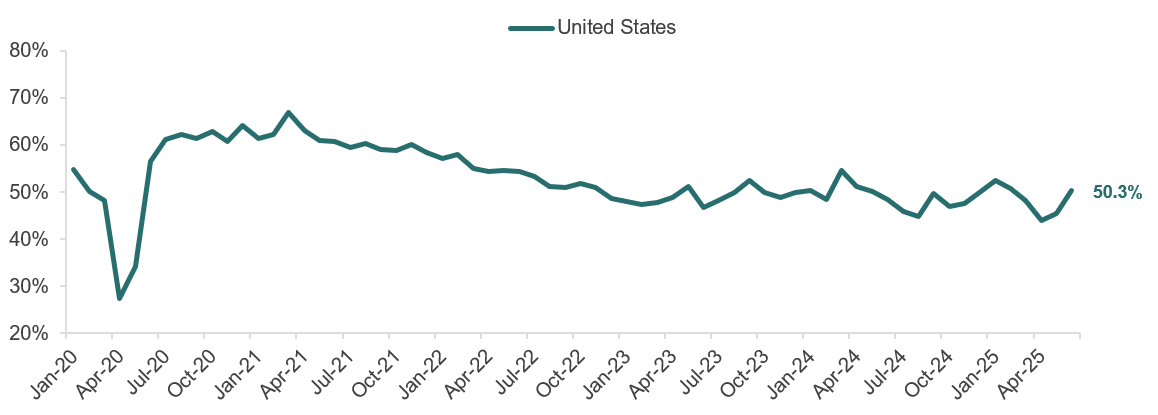

Manufacturing sentiment & demand

- Manufacturing PMI readings in both the U.S. and Europe have hovered below 50 percent since mid-2022, as persistent cost pressures, elevated interest rates, and weaker global demand have weighed on confidence and slowed the pace of industrial recovery

- U.S. manufacturing new orders have trended downward since early 2022 and remain below prior peaks, reflecting softer capital goods demand, reduced customer backlogs, and ongoing caution in restocking activity

- The continued softness in purchasing activity and weak order pipelines point to a manufacturing sector that remains cautious and demand-constrained, with producers prioritizing operational efficiency and inventory discipline over growth, and waiting for a clearer signal of sustained end-market recovery before reaccelerating production or investment

ISM Manufacturing Purchasing Managers’ Index (“PMI”)

ISM Manufacturing New Orders Index

Source: Institute for Supply Management

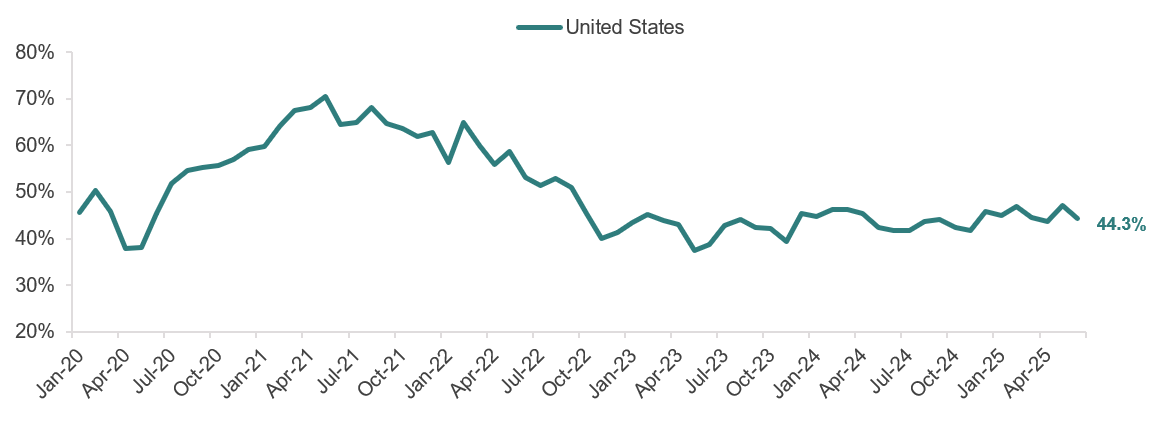

Manufacturing output & backlog

- Manufacturing production has steadily declined since early 2022, with output levels softening as producers adjust to weaker order volumes, tighter financial conditions, and persistent margin pressures that have limited their willingness to ramp capacity

- Backlogs of manufacturing orders have followed a similar downward trajectory, falling significantly from 2021 highs and remaining muted as customer demand normalizes, lead times shorten, and fewer disruptions necessitate large advance orders

- The continued slide in both output and backlog levels underscores a sector that is no longer supply-constrained but instead demand-limited, with manufacturers taking a more cautious and efficiency-focused approach to operations amid slower intake and limited pipeline visibility

ISM Manufacturing Production Index

ISM Manufacturing Backlog of Orders Index

Source: Institute for Supply Management

Download full report

To explore the full report – including key drivers, selected trends, and the M&A environment in industrial automation – download the full report at the top of the page.

Get in touch

If you have any questions about the report or the industrial automation market, please contact Franz Schranner.

Get in touch