SOFTWARE VALUATIONS INSIGHTS | Q2 2025

Our quarterly Software Valuations Insights Report is a vital resource for SaaS founders, CEOs, and Investors, offering comprehensive analysis and insights into the valuation of public software companies

The report is divided into ten benchmark segments, providing a detailed examination of the performance and outlook across various software verticals. It delivers essential data and trends, enabling informed decision-making in the rapidly evolving software industry

Key takeaways from the Q2 software valuations insight update include:

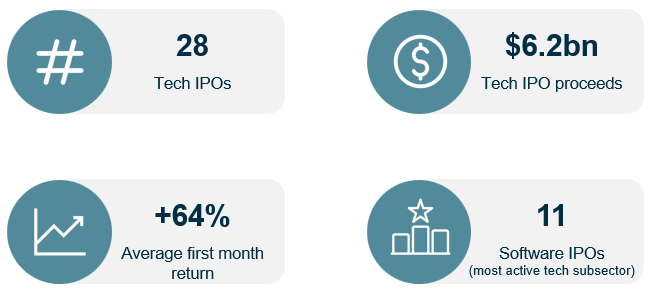

- Analysis of the broad IPO market recovery in the second quarter, led by a notable surge in technology listings. Tech IPOs significantly outpaced the market, delivering an average Q2 return of over 125 percent and rebuilding investor confidence after a period of volatility

- Founders of high-quality software companies are being nudged toward the public markets by a greater willingness to accept more realistic valuations. Investor appetite has sharpened, with a clear focus on companies that can demonstrate a credible AI strategy, alongside a clear monetisation strategy and path to profitability

- The pipeline includes a significant number of software unicorns, though investor scrutiny is high, particularly on unit economics. Companies in high-demand sectors like cybersecurity and data infrastructure are receiving the warmest reception, reflecting the search for durable growth in the current landscape

Overall, the IPO market has shown renewed vigour after a volatile start to the year, buoyed by strong equity performance and pent-up demand to realise value held within private company holdings.

While the outlook remains positive, continued momentum will depend on a stable economic and policy environment, with the deep liquidity in the US likely to ensure it remains the premier venue for large technology floats

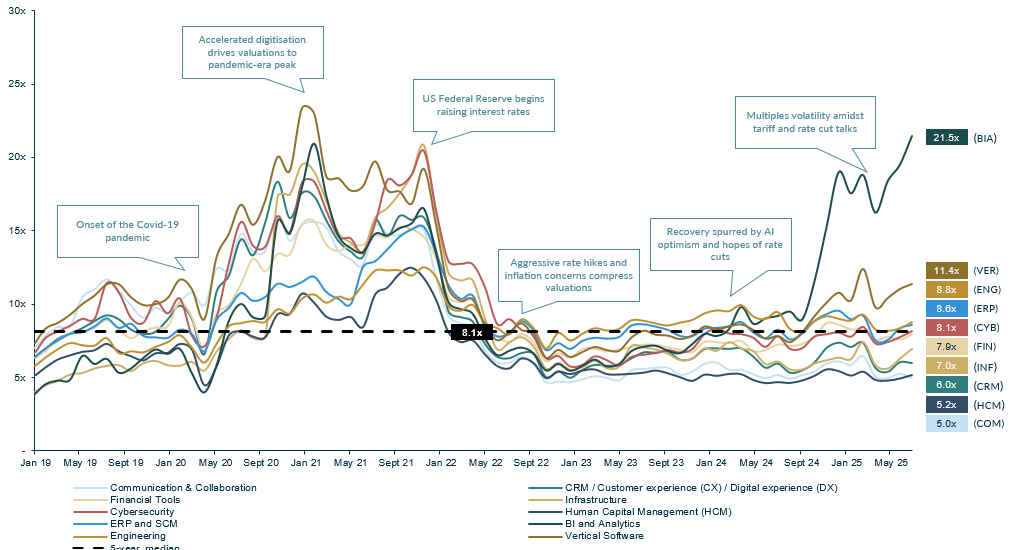

Public market software valuations rebound as tariff concerns ease

A strong recovery characterised public software valuations in Q2 2025. The optimism that was curtailed at the end of Q1 returned forcefully, as the resolution of tariff issues liberated the market from its key headwind. This sparked a significant rally and restored investor sentiment, leading to a strong performance as the quarter concluded.

Tech IPOs deliver outsized returns

Aftermarket performance for new listings improved dramatically in Q2, rewarding investors and boosting market confidence. Technology IPOs were the standout performers, delivering an average return of 125 percent, significantly outpacing the 41 percent average gain for the broader cohort. This substantial outperformance is a critical factor in drawing further high-quality tech issuers to market.

Tech deals prominent in healthy IPO pipeline

The forward-looking IPO pipeline remains robust, signalling sustained activity for the second half of the year. There are currently 171 active filings seeking to raise approximately $10 billion, with technology firms featuring prominently. Twenty-one of these are tech deals, underscoring the sector’s continued role as a primary driver of new market issuance.

US IPO Landscape

The IPO Window Reopens: Confidence and Capital Return in Q2

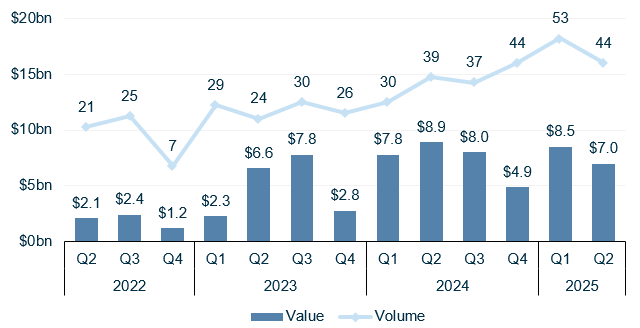

Quarterly value and volume of IPOs in the US (L3Y)(1,2)

U.S. IPO pulse

- 44 U.S. IPOs raised $7.0 bn in Q2-25 – c.+10 % YoY and >100% above the 21-IPO trough during Q2-22

- Tech contributed 7 IPOs in Q2-25 (17 tech deals YTD vs 23 in 2024), eclipsing last year’s pace

- Tech’s +125 % average Q2 return has outpaced the broader U.S. IPO cohort who returned +41 % on average during Q2-25

2025 IPO catalysts

- April tariff shock faded; softer U.S. inflation and lower volatility reopened the window by mid-May, reviving delayed filings

- Major liquidity push from VCs – 10 venture-backed listings raised $4.6 bn, the strongest quarter since 2021

Structural tailwinds for tech

- Fresh regulatory clarity (e.g., stablecoin bill) plus founders‘ valuation expectations are moving quality assets towards IPO

- 67% of all Q2 IPOs closed above issue, demonstrating that valuations are holding despite a busy calendar

- The recovery in public software multiples from a trough following rate hikes and geopolitical conflict is encouraging more IPOs

Pipeline & Outlook

- 171 active U.S. IPO filings seek c.$10 bn; 21 are tech deals, with eight aiming for $100 m+ raises

- Market outlook is for a muted July and August lull, then a post-Labor-Day acceleration if macro tailwinds persist

- Globally, Europe & Asia are warming too, but deep U.S. liquidity should keep it the marquee venue for mega-tech floats

Technology IPO stats (LTM)(1,3)

Notes: 1) Excludes closed-end funds, unit offerings, and SPACs; 2) IPOs and direct listings with a market cap of at least $50m; 3) Renaissance Capital Sources: D.A Davidson MCF International research, Pitchbook, EY, Renaissance Capital

Quarterly Insights on Public Software Valuations

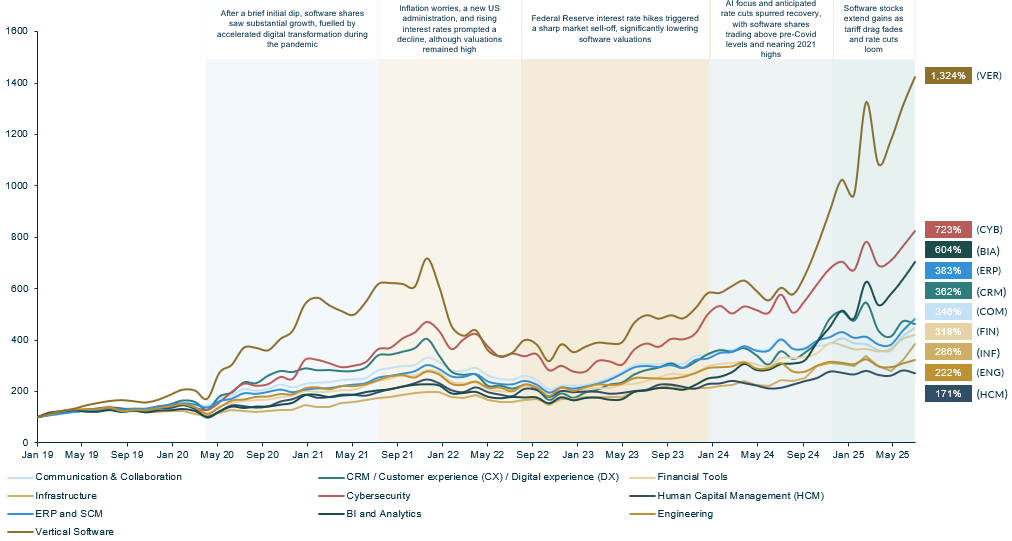

Share price index

Software stocks shrug off tariff uncertainty and surge towards all-time highs

EV/NTM REVENUE

In lockstep with share prices, forward revenue multiples are rebounding strongly from the recent tariff-induced decline

Source: S&P CapIQ as at 30-Jun-25

Download

The full report, including public comparables by software verticals, can be downloaded at the top of the page.

Contact us

If you have any questions about the report, don’t hesitate to get in touch with one of our team. You can find more information about our tech capabilities here.