Industrial Technology: Automation Market Update | Fall 2025

An Experienced, Proven, and Trusted Advisor in the Industrial Automation Sector

D.A. Davidson | MCF Finance Industrial Technology team is among the most experienced and active in the industry, with over 90 years of cumulative experience and over 200 global transactions completed. Our extensive experience and network of relationships worldwide allow us to provide a full range of highly customized M&A, debt advisory, and equity capital markets solutions to privately-owned, sponsored backed, and public companies around the world.

Macroeconomic Update

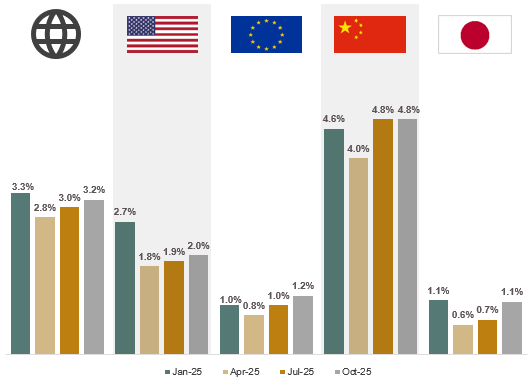

- Global GDP growth outlook for 2025 improved for the second straight quarter after downward revisions in April; while still marginally below prior year expectations, global growth outlook rose to 3.2%

- Financial conditions in most major economies are adjusting to a landscape shaped by new policy measures and have been fairly resilient after the tariff uncertainty for much of April – June 2025

- While still elevated from a historical perspective, the U.S. effective tariff rate has come down from “Liberation Day” levels, moderating from 25%+ to 15%+

- While conditions remain steady, the market continues to closely monitor the impact of tariffs on economic sentiment, inflation expectations and interest rates globally

Real GDP Growth Forecast (2025)

Industrial & Manufacturing Performance Indicators

- Industrial production in both the U.S. and Europe has increased in recent months as easing inflationary pressures, improved supply chain reliability, and gradual normalization of demand have collectively supported a mild improvement in manufacturing output

- Capacity utilization rates point to retained industrial flexibility, with U.S. and European manufacturers operating at stable but slightly declining levels, reflecting disciplined capacity management and conservative capital spending amid lingering cost pressures and uncertain demand visibility

- Manufacturing sector conditions have largely stabilized following COVID-related disruptions in mid-2020 and the subsequent 2021 recovery; firms are maintaining a focus on cost efficiency while improving visibility into customer demand, but activity remains constrained by labor tightness and cautious customer ordering amid overall economic uncertainty

Manufacturing Sentiment & Demand

- Manufacturing PMI readings in the U.S. rose to 49.1% and Europe fell to 49.8%, indicating some softness in the manufacturing economy, but Europe rose above 50% in August for the first time since 2022

- U.S. manufacturing new orders hovered near breakeven after showing a positive trend in late 2024; demand and output are stabilizing after an early 2025 slowdown caused by tariff-induced uncertainty created softer capital goods demand, reduced customer backlogs, and ongoing caution in restocking activity

- Manufacturers continue to optimize efficiency and inventory management while actively tracking end-market demand indicators; companies are taking a measured approach, ensuring they’re well-positioned to deploy capital and ramp production as demand trends strengthen

Manufacturing Output & Backlog

- Manufacturing production continued to rebound after reaching a low in April, indicating that output is stabilizing after a sharp pullback in early 2025

- Backlog of manufacturing orders remained low, falling significantly from 2021 highs and remaining muted as customer demand normalizes, lead times shorten, and fewer disruptions necessitate large advance orders

- Output and backlog trends show manufacturers carefully matching production to market demand while maintaining operational discipline; the normalization of inflation and supply chains has eliminated

previous headwinds, positioning U.S. manufacturing on solid footing to capitalize on demand recovery

as 2026 approaches

Subsector Deep Dive: Packaging Automation

Uncertainty Continues to Slow Growth

While growth in 2024 reached a solid 2.7%, it reflected a more measured pace than in prior years as businesses navigated elevated interest rates and economic conditions. The Federal Reserve’s mid-year rate cut signaled improving sentiment and sparked renewed momentum in the second half of 2024. As the U.S. election approached, many forward-thinking companies strategically accelerated purchases to position themselves ahead of potential policy changes, demonstrating proactive planning in a dynamic environment.

Entering 2025, optimism was building that market clarity would emerge following the election and anticipated Federal Reserve rate cuts. The first half brought unexpected developments, with tariff policies evolving across several countries as governments worked to establish new trade frameworks. In response, many companies took a prudent approach to capital investments, demonstrating fiscal discipline while closely monitoring the shifting policy landscape for the right opportunities to act.

Looking ahead to the remainder of 2025 and into 2026, businesses are continuing to take a strategic approach to equipment investments as they adapt to evolving market conditions. While some companies are refining their strategies amid the changing environment, the fundamentals remain stable with steady growth projected at 2.2% for 2025. This resilient performance, even in a period of transition, reflects the underlying strength of the sector and positions companies well for accelerated growth once greater policy clarity emerges.

Market Sector Breakdown

Food

The food industry continues to lead as the largest segment, representing 43.5% of packaging machinery shipment value in 2024. Investment in food-sector facilities remained robust, with leading companies such as Nestlé and Campbell Soup Co. committing over $575 million across six plants – demonstrating sustained confidence in capacity expansion and modernization initiatives.

Beverage

Representing 15% of the market, the beverage sector holds the second-largest share. Following a strong rebound in 2023, investment activity in 2024 reflected a more measured pace as companies focused on completing several major projects already underway. Encouragingly, early indicators point to renewed momentum building for 2025. Even as businesses take a strategic approach to capital spending, the sector remains dynamic – with brands actively innovating across new beverage formats and making meaningful progress in transitioning away from plastic packaging.

Pharmaceuticals

The pharmaceuticals sector demonstrated a growth rate of 5.5% in 2025, remaining the fastest growing among all sectors in the U.S. Additionally, there is a notable increase in pharmaceutical plant investment announcements in 2025, with total investments exceeding $100 billion as major companies commit to onshoring efforts in the U.S. in response to tariff policies.

Download

The full report, including public company metrics & commentary as well as equity capital markets activity, can be downloaded at the top of the page.

Contact us

If you have any questions about the report, don’t hesitate to get in touch with one of our team.

MCF deal team