SOFTWARE VALUATIONS INSIGHTS | Q3 2025

Our quarterly Software Valuations Insights Report serves as a key resource for SaaS founders, CEOs, and investors, offering in-depth analysis and insights into the valuation landscape of public software companies.

Divided into ten benchmark segments, the report provides a comprehensive examination of performance and outlook across diverse software verticals. It delivers critical data and emerging trends, empowering stakeholders to make well-informed strategic decisions in the fast-evolving software industry.

Key takeaways | Q3 2025 public software valuations

Software shares extend gains, but market discipline returns

- Software equities extended their AI-fuelled rally through Q3, with most subsectors pushing to new highs and participation broadening. While headline valuations are near records, EV/NTM revenue remains subdued versus the 2021 peak – median multiple across our peer groups is 5.4x

- This seems to imply that fundamentals are doing more of the heavy lifting – earnings power is strengthened by AI enhanced products, allowing prices to rise without a comparable expansion in revenue multiples

Profitable growth continues to supersede “growth at all cost”

- Over 2025, the defining trend continues to be the shift towards profitable growth as the core value driver. Capital markets tend to favour balanced models

- Companies delivering double-digit growth with expanding margins outperform peers chasing scale alone

- This market re-rating highlights operating leverage, recurring revenue, and cash conversion performance as key metrics that support a durable valuation

Vertical and AI-enabled platforms lead valuation premiums

- Valuation premiums remain concentrated in AI-rich verticals. Vertical Software (9.6x) and Engineering (8.7x) commanded the highest multiples, driven by domain depth and automation adoption

- More mature categories like CRM/CX (4.0x) and HCM (4.4x) saw some moderation by comparison as growth rates normalised

- Investors continue rewarding vertical focus and defensible AI-enabled differentiation

Quarterly Insights on Public Software Valuations

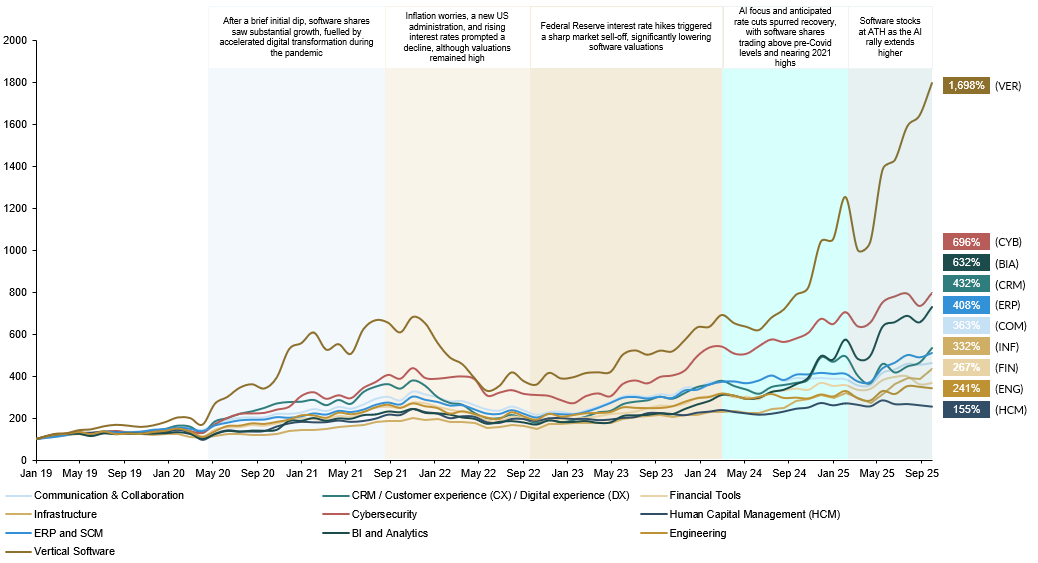

Share price index

Software stocks broadly move to all time highs fuelled by strong earnings and AI

Source: S&P CapIQ as at 30-Sep-25

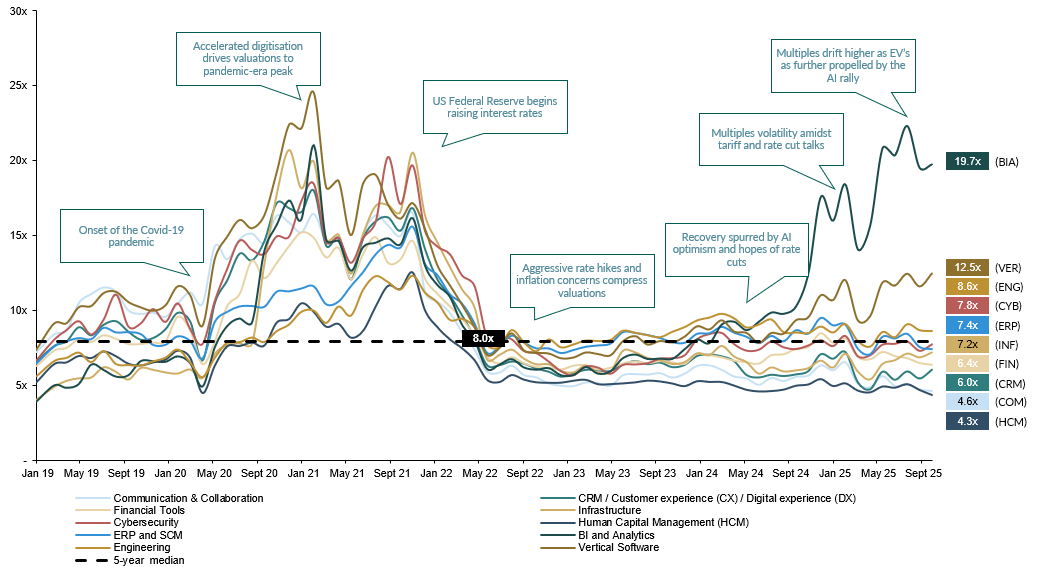

EV/NTM Revenue

Valuations are rebounding strongly but not reminiscent of 2021 exuberance, as earnings keep pace with valuation expectations

Source: S&P CapIQ as at 30-Sep-25

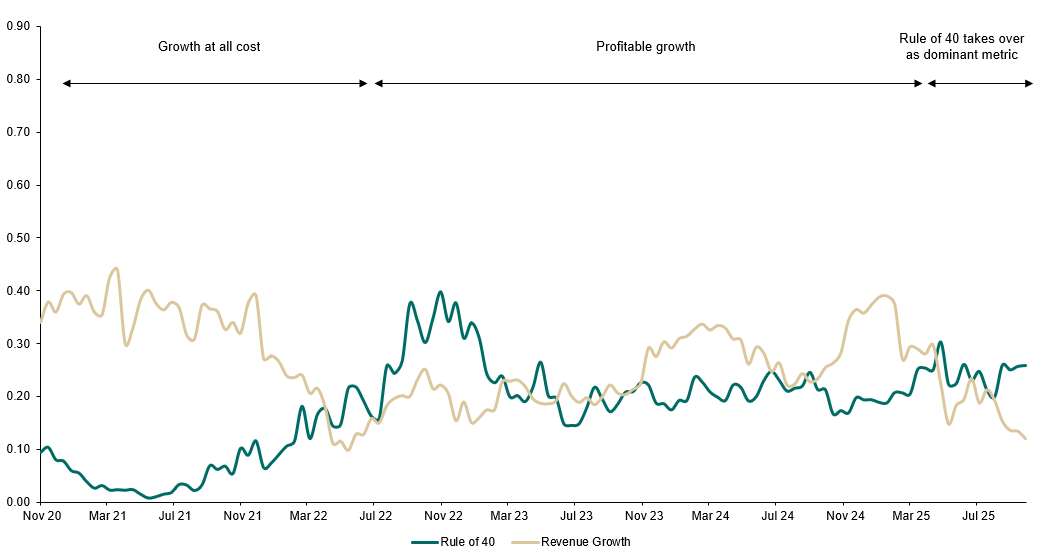

Increasing relevance of Rule of 40 as growth slows down…

Whereas growth was the primary driver of valuation during Covid, the combination of profitability and growth (i.e. “profitable growth”) has taken over (Rule of 40)

R-squared values over time

Source: S&P CapIQ as at 30-Sep-25

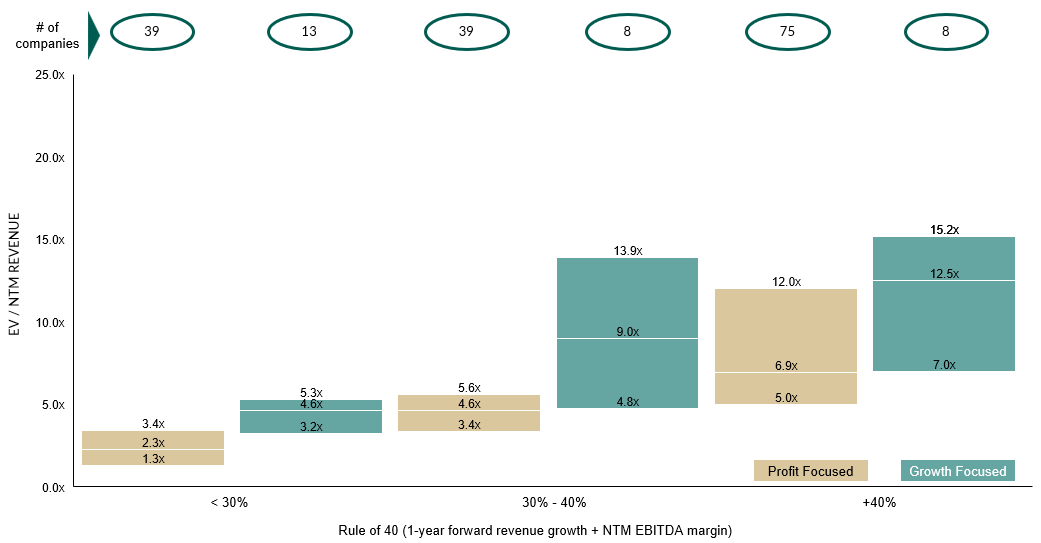

…although growth remains the dominant value driver over profit

Investors now look at a combination of profit and growth to determine valuation, while growth remains the more important constituent in the Rule of 40 rather than profitability.

Valuation spread of growth vs profit(1)

Notes: 1) Growth focused means that the growth component within the Rule of 40 is larger than the profit component and vice versa for profit focused Sources: S&P CapIQ as at 30-Sep-25

Download

The full report, including public comparables by software verticals, can be downloaded at the top of the page.

Contact us

If you have any questions about the report, don’t hesitate to get in touch with one of our team. You can find more information about our tech capabilities here.

Previous Software Reports

SOFTWARE VALUATIONS INSIGHTS | Q2 2025

SOFTWARE VALUATIONS INSIGHTS | Q1 2025

MCF deal team