Business Services M&A: Accounting and Finance BPO – Q1 2024

Industry Update

The accounting and finance BPO (Business Process Outsourcing) market is evolving, driven by behaviour, technology, and legislative changes that are reshaping clients’ needs. As a result, several new regional champions have emerged, targeting the attractive SME segment with offerings that combine expertise with tech-enabled delivery. This development is expected to accelerate, driven by several market trends that favour tech-enabled BPO providers, further increasing the market’s appeal to financial sponsors.

The market has been redefined by four trends

Outsourcing: Increasing outsourcing of finance and accounting functions, with a trend towards leveraging external expertise and resources to streamline financial operations.

Digitalisation: Ongoing digitalisation remains a powerful force driving the industry, necessitating continuous investment and expertise. This shift is proving challenging for smaller local players.

Legislation: The growing complexity of the regulatory landscape necessitates external expertise, amidst increasing pressures stemming from anti-money laundering, GDPR, and ESG reporting requirements.

Entrepreneurship: The rise of the gig economy and entrepreneurship is driving increased demand, emphasising the need for accessible and cost-effective solutions for smaller players.

A&F BPO | Market Overview

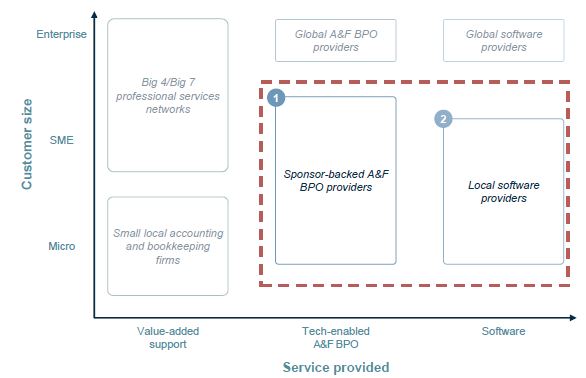

Private equity has been the driving force in catering to the SME segment with tech-enabled BPO and software platforms.

Historically, the market was dominated by global providers, small local mom-and-pop shops, and big accountancy firms. However, the competitive landscape is rapidly evolving as acquisitive players on the BPO and software sides offer a strong value proposition for SME clients.

- Several sponsors are transforming the market by developing tech-enabled and highly acquisitive BPO platforms specifically tailored to the SME segment. Despite this consolidation, the market continues to be fragmented, with a long tail of small firms still actively serving the SME segment.

- Local software providers maintain a dominant position among SMEs in the respective markets, often providing a degree of consulting services in addition to their products. Their solutions, designed for specific domestic geographies and/or customer segments, are not readily adaptable to new geographical areas.

MCF Case Study: Aspia

The Deal

IK Partners sold Aspia, a leading technology-enabled accounting, payroll, tax, and advisory services company, to Vitruvian Partners. Aspia employs approximately 1,300 professionals and has a market-leading profitability.

With the support of IK, Aspia has built a strong platform for future growth through broadening its customer base across small, medium, and large customers; expanding its service offering; enhancing its presence across the Nordics while also earning a reputation as one of the best places to work in the region. In addition, Aspia has become the most efficient technology-enabled advisory and outsourcing provider in Sweden, developing a set of industry-unique digital tools such as Aspia Go, MyBusiness, and Acture (ESG) that greatly enhance the quality of the services that Aspia is delivering to its customers.

Underpinned by the growing awareness of the mission-critical nature of outsourcing services against the backdrop of an increasingly complex financial and regulatory environment, Aspia is benefiting from a rapid digitalization trend. The company is quickly becoming one of the most well-respected providers of technology-enabled outsourcing services delivered through a proprietary digital customer interface portal, with ample growth potential in both existing and new markets.

Transaction Highlights

- Successful exit from IK Partners Mid Cap fund at the time.

- Together with Vitruvian, Aspia will continue its growth journey across multiple markets and service areas, in addition to further investing in the digital platforms available to its customers.

- This marks yet another successful transaction within MCF’s Business Services vertical.

We are confident that Aspia, with the support of Vitruvian, will be able to continue accelerating its growth journey and benefit from their expertise in growth and technology-enablement.

Ola Gunnarsson, CEO Aspia

Business Services at MCF

Our mission is to provide honest and relationship-driven M&A and debt advisory services.

The MCF Business Services team has successfully advised clients on both sell-side and buy-side transactions. Our track record and past mandates highlight our sector expertise and industry network. Our deep industry knowledge stems from our strong relationships with key market players across Northern Europe and internationally, further enhanced by our partnership with D.A. Davidson in North America.

If you’re seeking M&A advice for your business, don’t hesitate to get in touch with us to explore how we can support your objectives.

Get in touch