Consumer M&A: Products – Spring 2023

Industry Update

The pandemic shocked the global economy but so has its aftermath. The Consumer Products market entered 2023 with an economy experiencing rife inflation, rapid monetary policy tightening, and recessionary risk. Supply chains remain disrupted, and crises from war adds to the turmoil.

Opening notes on the Consumer Product M&A Market

The pandemic shocked the global economy, and its aftermath continues to ripple through the Consumer Products market as we entered 2023. This sector is now navigating an economy fraught with challenges: rife inflation, rapid monetary policy tightening, and looming recessionary risks. Additionally, supply chains are still disrupted, compounded by crises from ongoing conflicts, adding to the existing turmoil.

Uncertainty surrounding the depth and duration of a potential recession has led to a significant decrease in M&A activity within the European Consumer Products industry, dropping by 38% in the first quarter of 2023. The combination of interest rate hikes, market volatility, and declining consumer confidence has resulted in value gaps, which are hampering deals.

Companies focused on consumer goods have found themselves tightening budgets and pivoting their strategies away from portfolio expansion. Despite these ongoing market challenges, they have also presented opportunities for more traditional consumer-centric companies to reshape and refine their assets through cost-cutting and enhanced efficiencies. Interestingly, despite the challenging macroeconomic environment, consumers have remained steadfast in their spending, much to the frustration of central banks. Moreover, the disruption in the production and distribution of grains and fertilisers has led to increased food prices, prompting greater price sensitivity among consumers regarding discretionary spending. Nonetheless, global consumer spending remains robust, demonstrating the complex interplay between economic challenges and consumer behavior.

2023 Trends & Market Outlook

- E-commerce has injected tremendous amounts of competition into the world of Consumer Products. E-commerce platforms are where a growing share of products are sold and where companies need to place their products to find new customers. E-commerce ubiquity has caused the next generation of consumers to have some of the lowest levels of brand loyalty.

- The pet industry continues to shine as one of the brightest areas of M&A activity in the Consumer sector. Much of the M&A activity has been focused on market share or geographic expansion, product diversification, or cost synergy opportunities.

- Trade players that can fund acquisitions with their balance sheets may continue to be active in M&A while private equity investors, on the other hand, have been limited in their ability to transact as long as uncertainty around interest rates persists due to difficulty in obtaining financing for leveraged deals.

- While challenges remain on the Consumer Products front for 2023, portfolio reviews and a focus on transformational transactions will create M&A opportunities.

Words from our US Colleagues

Consumer products exceed expectations

Consumer Products continue to outperform expectations, but that may be partially due to the low bar that was set earlier in the year. As we look back on the most recent quarter, we find that sentiment and expectations for the remainder of the year are largely unchanged from the previous period, “cautiously optimistic.” Although the most pressing issues such as input costs, supply chain disruptions from COVID, and inflation have alleviated from their peaks, they persist when compared to two years ago. We have still not seen a recession in the U.S., but sentiment indicates that it is still on the consumer’s mind.

Companies in the Consumer Products space have echoed feelings of cautious optimism as they move into the second half of 2023. Sales are growing, margins are increasing, and things seem to be returning to normal. Even so, expectations remain tempered as consumers contemplate what a recession would mean and restrict spending to non-discretionary and value purchases. The upside to the cautious environment is that we may continue to see financial results beat expectations.

Organic sales are up

Consumer Product companies such as Clorox and P&G, as well as retailers such as Walmart and Target have reported organic sales growth across categories. Beauty and personal care have consistently been recent winners, while apparel has been a laggard. Geographically, the U.S. consumer has remained strong and been a primary contributor to sales growth, while European consumers have been more subdued by higher rates of inflation experienced. China has also contributed to recent sales growth as they emerge from COVID lockdowns later than the West and Chinese consumer sentiment improves.

Profitability is increasing

Companies have reported that profit gains have outpaced sales gains in the recent quarter and are expected to further improve as inflation and supply chain costs continue to ease. Although cost pressures have stabilized, they are still above periods two years ago and will likely take several more quarters for pre-pandemic margins to return. Price increases have generally been received well and have started to cover increased costs, but manufacturers and retailers are both very aware that the consumer is under pressure and may not be able to absorb much more.

Consumer sentiment continue to weigh on discretionary sales

Although the U.S. Consumer has remained more resilient than expected, the combination of increased prices and caution around a pending recession has continued to change shopping behavior. Target has reported softening sales in discretionary categories, and Walmart has reported increased sales from high-income shoppers. Walmart has also seen an increase in private-label sales as shoppers seek value and sacrifice brand-name products.

Convenience is important to driving sales

Global M&A Transaction News

XXXLutz acquires home24

XXXLutz, the Austria based furniture retailer announced it has acquired home24, the software e-commerce home furniture store for ~USD270m. The new partnership strengthens market position and growth prospects for both companies. A successful e-commerce offering, capabilities, and relating insights are becoming increasingly important for larger corporates. Read more.

L’Oréal announces plans to acquire Aesop

L’Oréal announced it is to acquire Aesop, a skincare and cosmetics brand for ~USD2.5bn. The acquisition will be L’Oreal’s largest and will strengthen its leadership in the natural cosmetics market with an aim to expand into China and Travel retail. Leading beauty players continue to acquire successful brands to expand their portfolios and accelerate the target’s growth through the acquirer’s distribution platforms. Read more.

Partners Group, with CVC, increases stake in Breitling

Partners Group, with CVC, increased its stake in Breitling, the leading Swiss watchmaker at a ~USD4.5bn valuation. The acquisition will support geographic expansion and the launch of new products harnessing the value of Breitling’s extensive back catalogue. Private Equity investment remains robust for high quality, premium assets with clear growth opportunities in place. Read more.

Heroes acquires Magmatic

Heroes, the UK based e-commerce startup announced it has acquired Magmatic – Trunki, the manufacturer of children travel products, from BGF for ~USD15m. The acquisition will strengthen Heroes’ focus in the baby and children category. Shifting consumer behaviour has benefitted brands operating on 3rd party e-commerce platforms, with aggregators acquiring and optimising independent Amazon businesses. Read more.

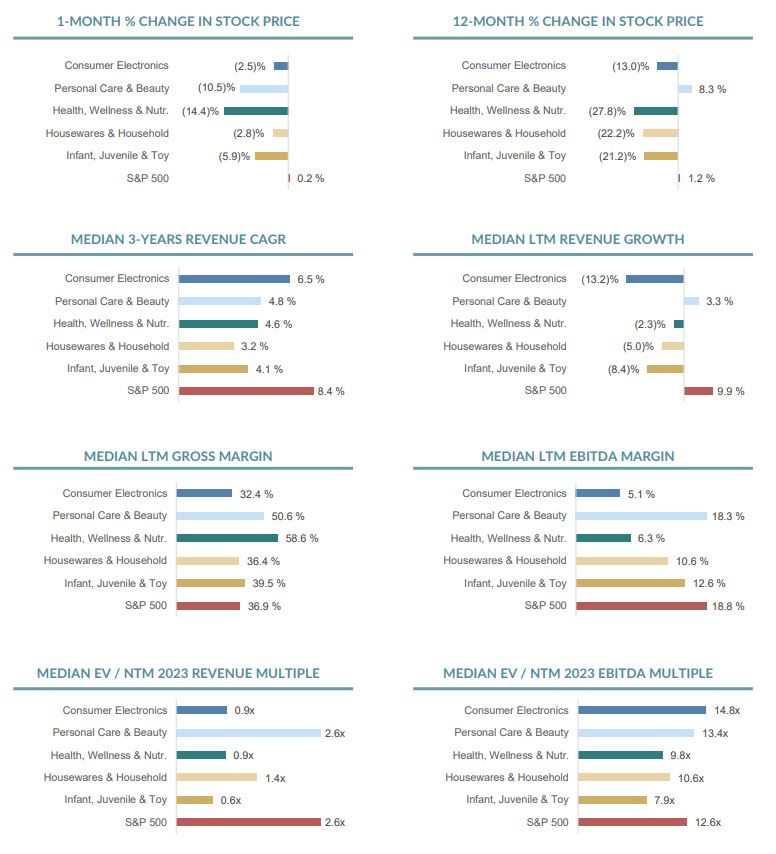

Public Company Valuation & Operating Metrics

Source: S&P Capital IQ, as of 31/05/2023

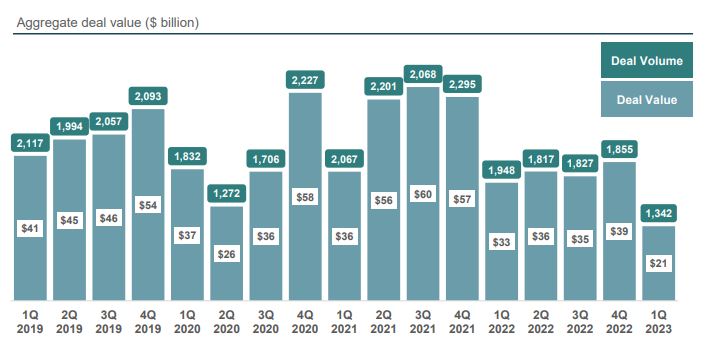

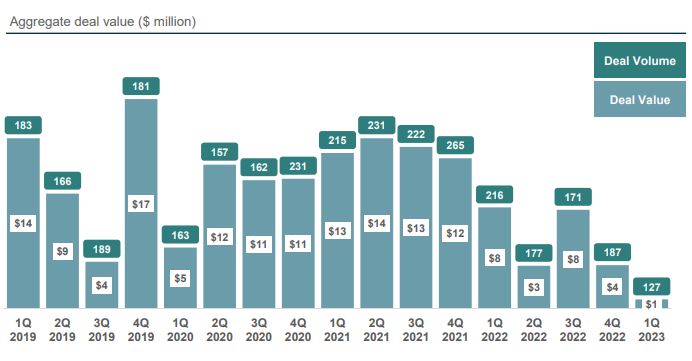

Quarterly Consumer Middle Market

Quarterly Consumer Products Middle Market M&A Volume

For more information including data on public comparable companues by subsector please see the full report.

The D.A. Davidson MCF International Offering

Each business is different and so is our approach. We combine entrepreneurship, customized processes as well as expertise in consumer sectors middle market transactions. For us, tailor-made M&A and debt advisory means that every client receives relationship-driven advice. We speak the truth, invest in relationships and value trust above all else.

We hope this report has provided valuable insights and perspectives. To speak to use regarding plans for capital, acquisitions, or succession, please contact one of our investment bankers. You can find more information on our Consumer M&A services and team here.

Get in touch