Consumer M&A: Food, Beverage & Agriculture – Spring 2023

Industry Update

15 months after the outbreak of the Ukraine War and 3 years after COVID-19 hit Europe, it seems like food, beverage & agriculture (FB&A) has finally reached a new normal of sorts.

M&A Insights: A New Reality for Food, Beverage & Agriculture

Cost inflation and supply chain issues are now accepted reality, with players dealing nimbly with higher energy, logistics, materials, and personnel costs. Of course, some are better placed to deal with this situation. Public company reporting and our own market dialogues reiterate the key theme of the last year: brands with pricing power have used it to increase top line growth from lower volumes, all with the goal of maintaining stable profitability.

As we enter the second half of 2023, increased interest rates, recessionary concerns in key European markets, and acute public focus on FB&A price inflation now change the game again. Retailers, the public, and regulators are pushing back on pricing activity as input prices stabilize. We see private label market shares increasing, the retail mix changing in favor of hard discounters, and an emphasis on enduring brands. The jury is out on food service channels– the post-COVID-19 recovery continues to mask the potential effects of decreasing discretionary spending. This is boiling down to a new success formula: Strong, enduring brands matter more in holding pricing and attracting loyal consumers; new product development will be crucial to driving volume growth and reducing unit costs; companies with cost-effective production will pick up share either directly or through private label distribution.

So what does this mean for M&A? There is no question deal volumes have been stifled over recent years as strategic acquirers have focused internally, giving an advantage to well-capitalized private equity players. The pendulum is now shifting to strategic players with the financial capacity to absorb market share, drive synergies, and build out their capabilities. The tapering in valuation multiples and a tighter credit market are all reinforcing this shift. On the seller side, there is a window now for activity. We expect engagement from large corporates looking to realign their capital allocation strategy and growth-focused companies with tighter options in the capital raise space, among others. So it is not just summer to look forward to, but an M&A market which is well and truly open for business.

M&A News Worth Mentioning

Financial Times “Despite lower energy prices… growth in the cost of food has continued to soar… with policymakers resorting to price controls”.

Handelsblatt“A tough price war has been raging… Large consumer goods companies have increased their profits significantly in 2022, retailers slightly, while small producers lost margins.”

Matpriskollen“Since January 2022, prices have increased over 21%… Only now in April 2023 have we got a month where prices have actually decreased… This is for the first time in four years.”

Online Grocery

We have been watching the online grocery market with interest. After a COVID-19 driven demand jump, online-only grocers attracted significant venture & growth capital to scale and invest in new logistic chains. Similarly, established retailers have invested in their online businesses’ infrastructure. In this new reality, the question is if online grocers can maintain a sufficient cash runway and find a way to appeal to cost-conscious consumers. Norwegian player Oda, with industry-leading fulfillment and distribution efficiency metrics, has seen its valuation drop by two-thirds in its latest USD 150 raise at the turn of the year.

Their withdrawal from Finland points to investors’ desire to see a sustainable profitability profile. The same down round valuation story holds for Sweden-based Mathem, which is now competing against supermarket juggernaut ICA’s growing online business, centered around a newly established distribution centre using Ocado technology. But profitable growth can be done: UK-based Ocado Retail is now guiding a positive EBITDA for 2023. This is an area to watch closely. The long-term winners will be the players best able to react nimbly now.

Transactions in the News

Current Foods acquired by Wicked Kitchen

Current Foods, an alt-protein startup that provides plant-based seafood to food service and fine dining locations in the U.S. and Europe, has been acquired by Wicked Kitchen for an undisclosed amount. The acquisition will enable Wicked Kitchen to penetrate the plant-based sushi market and combine both brands into one seafood provider to the food service market.

J.M. Smucker Co sells select pet food brands to Post Holdings

The J.M. Smucker Co., a global diversified branded food and beverages product vendor, has sold select pet food brands to Post Holdings for $1.2B, representing a 0.9x EV/Revenue multiple. The acquisition marks the entry of Post into the pet food category, as part of its strategy of creating value through a buy-and-build approach.

M&A Observations from across the pond – Bio-diesel production and its effects

The interplay between rising energy demand and sustainability initiatives is notably impacting food pricing, an effect expected to persist. The surge in biodiesel production, driven by increased soybean oil usage as a primary feedstock, is pushing U.S. soybean acreage to record levels. According to USDA projections, the 2023-2024 U.S. soybean crush is set to hit an all-time high of 2.3 billion bushels, fueled by rising demand for soybean meal and oil.

This expansion in soybean production comes at the expense of other crops, leading to reduced acreage for wheat, flax, and oats. With demand remaining steady or growing for these displaced crops, a scenario reminiscent of the 2009-2014 ethanol buildout is unfolding, which previously drove agricultural commodity prices up by 27%.

However, the current biodiesel-driven dynamics unfold against a different economic backdrop compared to the ethanol era. Higher and climbing household debt levels, now at $17 trillion in the first quarter of 2023, and a lower unemployment rate of 3.7% in May 2023, contrast with the post-Great Recession period of the ethanol buildout. Consequently, the strain on consumer spending is more pronounced, with food prices 7.7% higher than the previous year and household food spending rising from 7% to 9% of income over the past 12 months.

Despite strong crop production this year mitigating some demand-supply imbalances, last year’s drought-induced price spikes hint at the potential for further increases. Additionally, climate change’s growing impact promises greater season-to-season volatility. While an increased supply of soybean meal could reduce livestock feed costs, thereby affecting meat pricing, it also risks widening the price gap with products from regenerative agriculture.

To cope with rising costs, consumers are increasingly opting for cheaper brands over premium ones, with 64% of Americans making this shift to manage high inflation, according to a Federal Reserve report. Private label brands have consequently seen a surge in demand. Additionally, there’s a noticeable consumer trend towards longer shelf-life products to maximize the value of their spending.

On a broader scale, the Bunge-Viterra merger announcement underscores significant shifts in the global agricultural landscape. This $18 billion deal aims to create a $34 billion agri-trading giant, potentially reshaping supply chains not only in the U.S. but also in other key exporting nations like Canada, Brazil, Australia, and Argentina. As authorities scrutinize this merger for its impact on market competition and consumer prices, the global food economy stands at a critical juncture, balancing between energy, sustainability, and the imperative to feed a growing population.

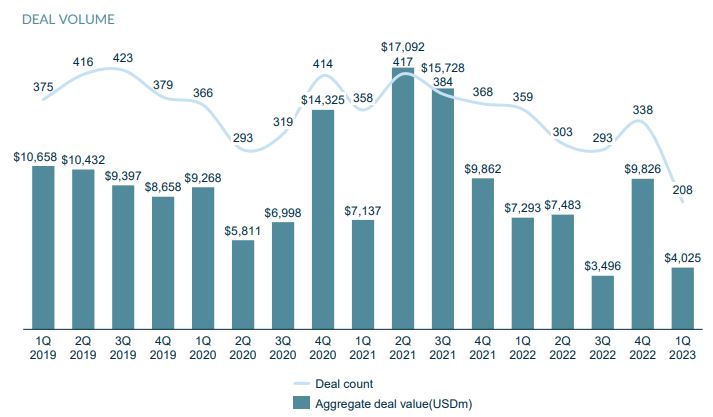

Quarterly FB&A Middle Market M&A Volume – Global

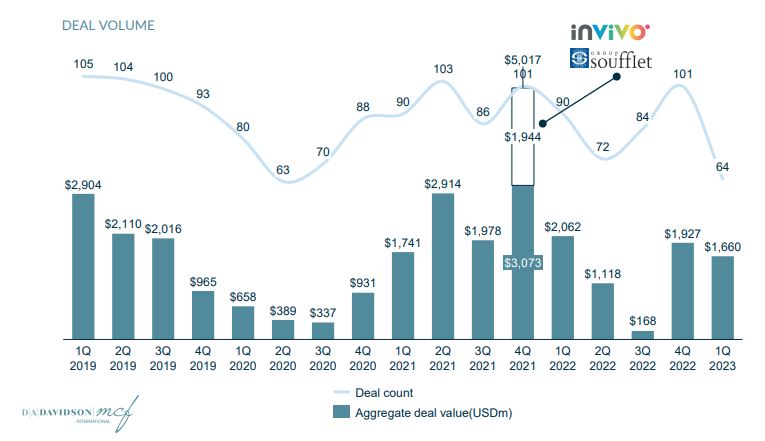

Quarterly FB&A Middle Market M&A Volume – Europe

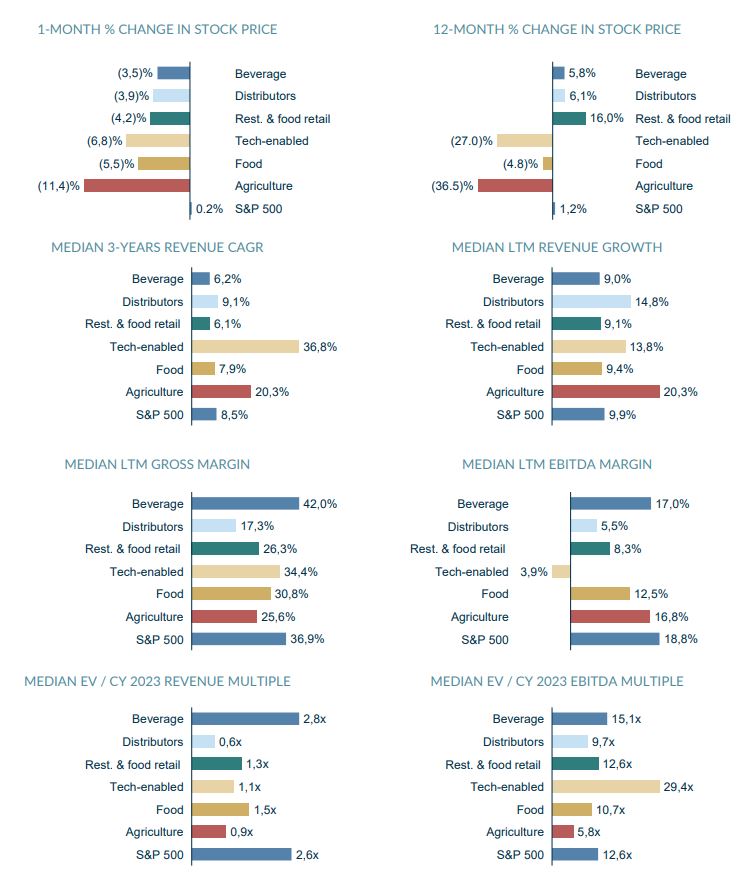

Public Company Valuation and Operating Metrics

For more information including data on public comparable companies by sector please see the full report which is available to download.

Our F&B Practice

Each business is unique, and our approach reflects that. We blend entrepreneurship with customized processes and expertise in consumer sectors and middle market transactions. Our commitment to tailor-made M&A and debt advisory ensures that every client benefits from relationship-driven advice. Integrity is at the core of what we do; we prioritize honest communication, nurture our relationships, and place the highest value on trust. To speak to use regarding plans for capital, acquisitions, or succession, please contact one of our investment bankers. You can find more information on our Consumer M&A services and team here.

Get in touch