SOFTWARE VALUATIONS INSIGHTS | Q4 2025

Our quarterly Software Valuations Insights Report serves as a key resource for SaaS founders, CEOs, and investors, offering in-depth analysis and insights into the valuation landscape of public software companies.

Divided into ten benchmark segments, the report provides a comprehensive examination of performance and outlook across diverse software verticals. It delivers critical data and emerging trends, empowering stakeholders to make well-informed strategic decisions in the fast-evolving software industry.

Key takeaways | Q4 2025 public software valuations

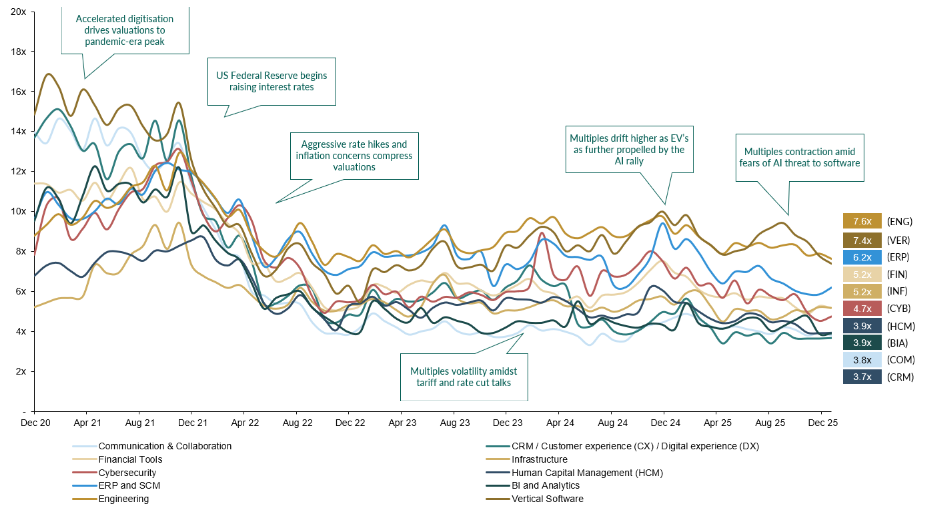

Multiples ticked down this quarter, but premium categories remain supported

- After a strong run-up, software saw slight multiple contraction in Q4, with the net impact modest versus the broader re-rating since 2023.

- The market remains selective: Vertical Software continues to command a clear premium (7.4x EV/NTM ), with BI & Analytics holding up (3.9x), while more challenged areas sit at the lower end of the range (Communication and Collaboration 3.8x; CRM & CX 3.7x). Overall, dispersion is widening as investors price defensibility over narrative

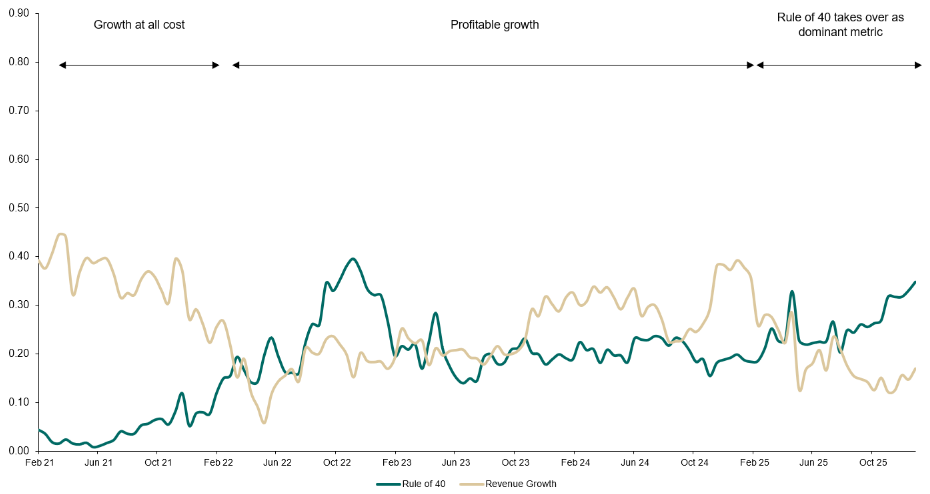

Profitable growth continues to supersede “growth at all cost”

- As growth has moderated, software valuations have become increasingly anchored to profitable growth rather than topline expansion alone.

- Companies combining solid revenue growth with improving margins and cash conversion continue to command premiums, while lower-quality growth is discounted.

- This is reinforcing Rule of 40 as the clearest shorthand for what the market is paying for: durable growth with credible profitability

Software M&A is picking up as investors lean into a buying opportunity amid AI fears

- With public multiples modestly compressed amid AI-disruption concerns, sponsor activity has accelerated as investors lean into improved entry points for defensible, workflow-critical assets.

- Recent transactions highlight this shift, including Clearwater Analytics (acquired by a Permira & Warburg Pincus–led group), Smartsheet (acquired by Blackstone & Vista), Zuora (acquired by Silver Lake & GIC), and Jamf (acquired by Francisco Partners), alongside continued take-private momentum from Thoma Bravo across Dayforce, Olo and Verint

Quarterly Insights on Public Software Valuations

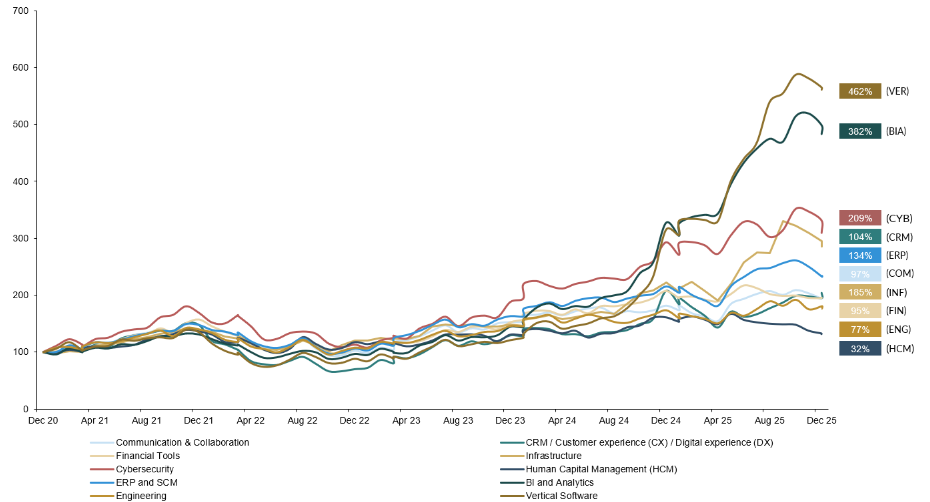

Share price index

Software stocks broadly move to all time highs fuelled by strong earnings and AI

Source: S&P CapIQ as at 31-Dec-25

EV/NTM Revenue

After a sustained re-rating, EV/NTM multiples have softened on renewed AI concerns, with dispersion persisting across verticals

Source: S&P CapIQ as at 31-Dec-25

Increasing relevance of Rule of 40 as growth slows down…

Whereas growth was the primary driver of valuation during Covid, the combination of profitability and growth (i.e. “profitable growth”) has taken over (Rule of 40)

R-squared values over time

Source: S&P CapIQ as at 31-Dec-25

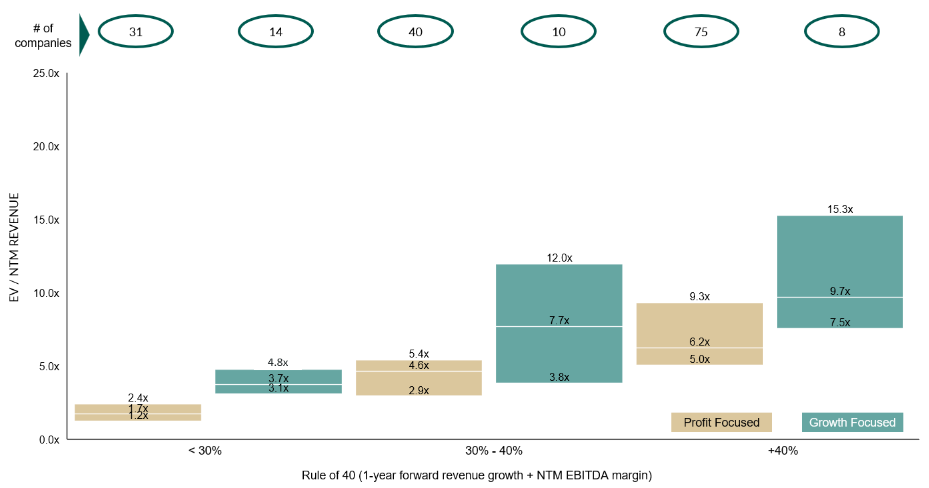

…although growth remains the dominant value driver over profit

Investors now look at a combination of profit and growth to determine valuation, while growth remains the more important constituent in the Rule of 40 rather than profitability.

Valuation spread of growth vs profit(1)

Notes: 1)Growth focused means that the growth component within the Rule of 40 is larger than the profit component and vice versa for profit focused

Sources: S&P CapIQ as at 31-Dec-25

Download

The full report, including public comparables by software verticals, can be downloaded at the top of the page.

Contact us

If you have any questions about the report, don’t hesitate to get in touch with one of our team. You can find more information about our tech capabilities here.

Previous Software Reports

SOFTWARE VALUATIONS INSIGHTS | Q3 2025

SOFTWARE VALUATIONS INSIGHTS | Q2 2025

SOFTWARE VALUATIONS INSIGHTS | Q1 2025

MCF deal team