Food, Beverage & Agriculture | M&A Industry Update | Q2 2025

M&A Activity holds firm amid challenging conditions in H1 2025

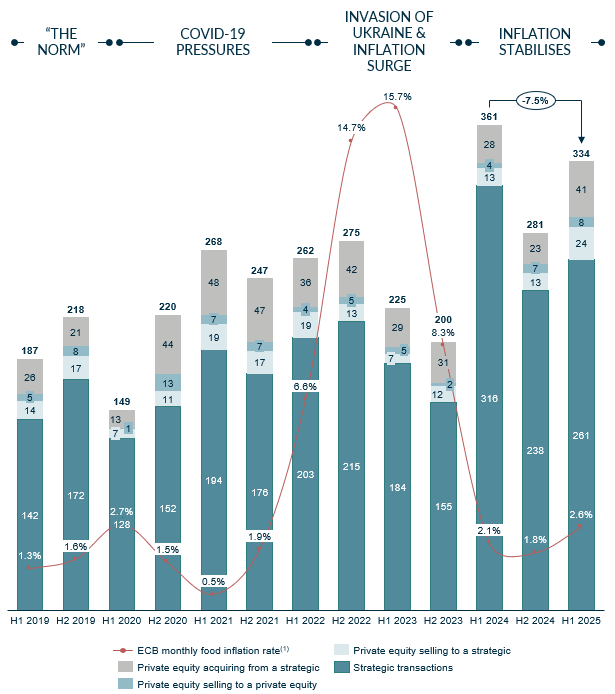

European Food, Beverage, and Agriculture M&A remained resilient to June 2025 despite geopolitical and macroeconomic uncertainties. Transaction levels in Q2 2025 decreased by 15.5% from Q1 2025 and H1 2025 was down 7.5% on H1 2024, yet it is notable that deal volumes still fell within the 2024 quarterly average and remain significantly higher than H1 2023 (+48.4%). This reflects a cautious optimism amongst investors amid stabilising rates and easing inflation. Appetite persisted for high-quality, growth-focused assets, particularly in defensible segments like bakery, food ingredients, dairy alternatives and premium goods. Deal activity was driven by both private equity and strategic buyers targeting businesses with margin visibility as the market continued to favour assets aligned with long-term consumer trends.

Three key focus areas as we move through 2025

1. Strategic repositioning by multinational food & beverage giants: Multinationals continued to divest non-core assets with a focus on premiumisation. In the beverages segment, Diageo withdrew from Distill Ventures, the global drinks accelerator, streamlining its business to focus on existing brands; in a similar vein, Pernod Ricard sold its international wine business and Campari Group divested its Cinzano and Frattina brands to concentrate on premium spirits. Within the food segment Unilever and Valeo Foods have also expressed intention to rationalise portfolios with Valeo prioritising non-savoury foods and Unilever looking to divest non-core food brands with a focus on premium brands within personal care, beauty and well-being.

2. Bakery & prepared foods: Q2 saw consolidation in this segment as Associated British Foods, owner of Allied Bakeries (Kingsmill), confirmed merger talks with Endless-owned Hovis; Valeo Foods expanded its sweet treats portfolio with the acquisition of Italian brands Melegatti 1894 and Freddi Dolcaria. In prepared foods, Greencore acquired Bakkavor for GBP 1.4bn, forming a UK ready-meal leader. Buyers remain focused on premium bakery and prepared food brands offering quality, convenience and strong market positioning.

3. Food ingredients: The European food ingredients sector is poised for continued activity in 2025 as the industry presents ample opportunities for consolidation. NovaTaste (PAI Partners) acquired Tec-Al, the food ingredients business, enhancing the group’s capacity to offer customised taste solutions across Europe. Rising demand for natural, healthy and clean-label products is driving acquisitions as companies adapt to shifting consumer preferences.

Engaging in future opportunities

Q2 2025 showed that while overall deal volumes remain slightly subdued, targeted M&A is active in categories with structural growth and strong brands. As confidence builds, portfolio reshaping and sub-sector consolidation will likely drive activity.

We would be pleased to discuss how we can help advance your strategic goals in this dynamic market environment.

Over the pond – H1 2025 review

M&A and capital markets are heating up

After a cautious start to the year, Q2 2025 saw an acceleration in M&A and capital raise activity across the U.S. food & beverage landscape. The market was bolstered by improved confidence in the macro backdrop, a growing consensus around a soft-landing scenario, and greater clarity on rate policy. As a result, both strategic acquirers and private equity sponsors have re-engaged, and auctions that were paused in 2023 or 2024 are now restarting with renewed momentum.

Strategics were especially active this quarter, highlighting a shift toward long-term category bets and core capability expansion. Notable transactions included Ferrero Group’s USD 3.1bn acquisition of WK Kellogg Co., Celsius Holdings’ USD 1.8bn acquisition of Alani, PepsiCo’s USD 2.0bn investment in Poppi, and Global Eggs’ USD 1.1bn acquisition of Hillandale Farms. The common thread: strong, differentiated brands with either a clear wellness positioning or a foothold in high-growth, in-demand categories.

Meat snacks and protein power a new wave of deals

Protein-rich and value-added meat snacks saw a resurgence in investor interest this quarter. Monogram’s acquisition of Western Smokehouse Partners represents a broader bet on growing consumer demand for portable, high-protein snacking. Meanwhile, protein has cemented itself as the default nutritional profile across a growing range of categories, from doughnuts and cheesecake to pretzels, pasta, bread, and energy drinks. What was once niche is now widespread, and M&A is following.

Global flavours go mainstream, authentically

U.S. consumers continue to embrace globally inspired cuisine, but the expectation has evolved from “ethnic-inspired” to truly authentic. Growth is strong in Korean, Indian, Middle Eastern, and Mexican cuisines, along with emerging hybrid categories like Indo-Chinese. We expect further M&A in these segments as founders and institutional capital recognise the long-term runway for culturally-rooted brands with loyal followings and differentiated flavour profiles.

Tariff uncertainty

Ongoing trade negotiations and the potential for new tariffs, particularly involving key import and export markets are prompting buyers to factor in risks around sourcing, margin compression, and cross-border supply chains. Fortunately, certain foods and ingredients receive tariff exemptions. Conversely, tariffs will also be a catalyst for M&A as buyers may value production in other nations even greater today, to avoid tariff impacts.

Looking ahead

The tone entering Q3 is constructive. If broader markets, consumer demand, and leverage availability remain stable, we expect M&A activity in the U.S. food & beverage industry to continue strongly. Wellness-forward brands, global flavour and ingredients platforms, high-margin snacking concepts, as well as the frozen, ethnic, and bakery categories will likely continue to lead the way.

Snapshot of European Food, Beverage & Agriculture M&A deal activity

Taking the long view – deal volumes near H1 2024 record levels

Number of announced acquisitions of European-based FB&A companies (deal value below USD 500m) & food inflation index rate from ECB.

Note: 1) Rate calculated as the median rate Source: Mergermarket, European Central Bank

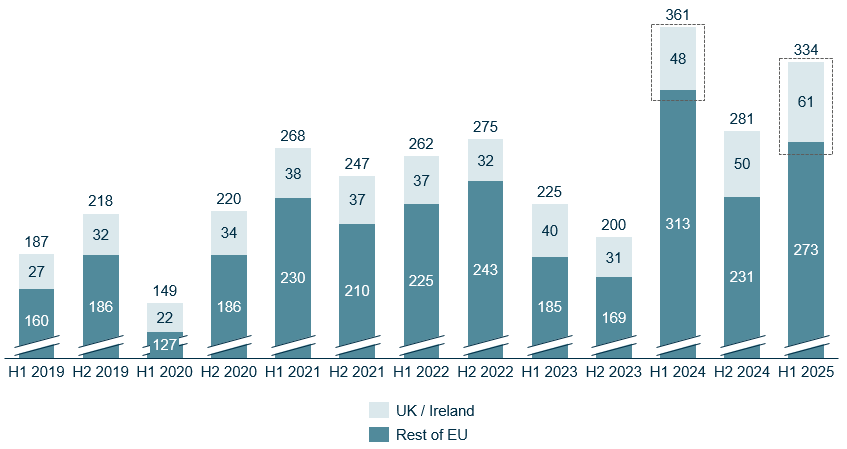

UK & Ireland deal activity increased 27.1% YOY to H1 2025, outperforming broader European trends

Number of announced acquisitions of European-based FB&A companies (deal value below USD 500m), divided by region of target company

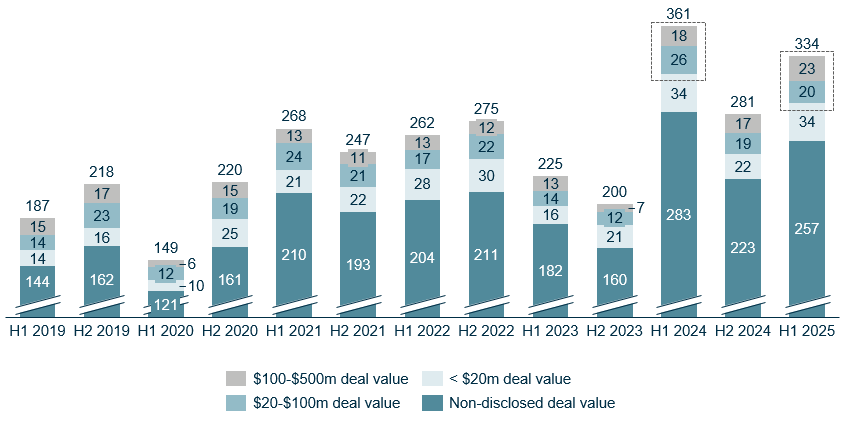

Mid-market deal activity in H1 2025 is level with H1 2024 with 43 deals between $20 and $500 (deal value)

Number of announced acquisitions of European-based FB&A companies (deal value below USD 500m), divided by deal size

Source: Mergermarket

Download

The full report, including public company valuations & operating metrics as well as public comparables by subsector, can be downloaded at the top of the page.

Contact us

If you have any questions about the report, don’t hesitate to get in touch with one of our team. You can find more information about our consumer capabilities here.

Previous F&B Reports

Food, Beverage & Agriculture – M&A Industry Update – Q1 2025