Consumer M&A: Food, Beverage & Agriculture – Q1 2024

Industry Update

The European Food & Beverage M&A sector faced significant challenges in 2023. Looking ahead, there are reasons for cautious optimism. In this report, our Consumer team reviews the market trends and discusses why the initial signs point to a promising year for M&A in the food, beverage, and agriculture sectors.

The full report, with company valuations and operating metrics can be downloaded here while the key highlights are discussed below.

M&A Picking up in the European Food, Beverage and Agriculture Market

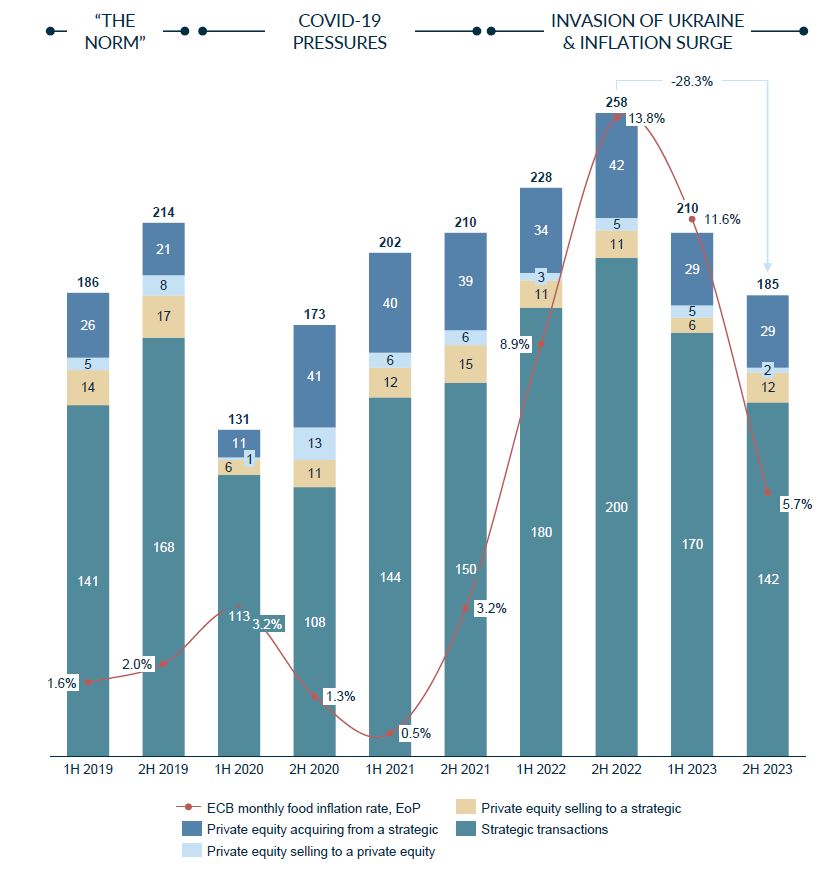

2023 proved to be a challenging year for European Food, Beverage and Agriculture M&A. Deal volumes decreased by 18.7%, with a total of 395 transactions compared to 486 in 2022. The decline was most pronounced in the second half of 2023, which saw a 28.3% reduction in transaction volumes. A backdrop of persistent inflation and subdued consumer spending continues to add complexity to the operational landscape for both buyers and sellers. Despite these hurdles, the outlook isn’t all doom and gloom.

The pace of private M&A deals going into 2024 year is in keeping with 2019, a year unaffected by COVID-19 or the impacts of an unstable inflationary environment. Recent trends show continued engagement from private equity and international buyers, alongside a consistent flow of transactions by strategic players adjusting their capital allocation strategies. When considering the M&A outlook for the upcoming year, we identify three main reasons for cautious optimism:

- The pressure from cost inflation has been easing. The operational climate has started to stabilise after two years of rising food inflation rates. Although pricing negotiations between brands and retailers persist, industry players have had an extended period to strengthen their supply chain and to manage the price volatility of ingredients, allowing strategic acquirers to take a longer-term perspective on M&A opportunities over immediate operational concerns.

- Valuations for companies in the food and beverage sector (excluding, notably, agriculture stocks) on public markets have found a footing after declining during 2023.

- Ongoing shifts in consumer behaviour, including the move towards plant-based diets, the popularity of healthy snacking, and the rise of private labels, continue to present opportunities for capturing significant market growth through M&A.

Therefore, while challenges remain, these factors collectively suggest a more favourable M&A landscape in 2024.

Views from our US partners

Like most investment bankers and other participants in the M&A and capital raising markets, we were excited to turn the calendar from 2023 to a fresh start in 2024. After 18-24 months of being amateur macroeconomists and Fed watchers, we’re excited to focus more on what truly drives long-term value in the food & beverage space: brands and products that resonate with customers, prudent capital allocation and relentless operational excellence. In our last update, we asked “are we there yet?” Today we feel confident in saying the M&A market is open for high quality businesses, with renewed interest from both strategic as well as financial buyers.

When will we see consistent unit growth at retail?

The story at retail in 2023 was brands increasing prices (or decreasing pack sizes) to respond to the rapid increase in input costs in 2022. As a result, many brands saw their dollar sales increase even as their unit volumes declined as consumers shifted to lower priced brands (or private label), decreased their frequency of purchase or reallocated their food budget more towards restaurants. Now that we are seeing a more stable pricing environment, we expect many brands to increase their promotional budgets to drive more unit sales while avoiding lowering their everyday pricing.

How will emerging brands be able to break through with less capital?

For several years, up and coming food and beverage brands were able to raise capital relatively easily, allowing them to make significant investments in new product development, consumer advertising and slotting fees to gain shelf space. Not surprisingly, these years saw a proliferation of exciting new products featuring innovative ingredient and flavor profiles, health benefits and product formats. With growth capital more scarce and a significantly higher emphasis on profitability, the last two years have seen a significant decline in new product development as emerging brands focused on cash preservation. Although we expect this relative lull in innovation

to continue, we believe that the businesses built in this environment will be stronger and more durable.

Will GLP-1’s truly transform the food & beverage industry?

There’s no doubt that the new class of GLP-1’s are already positively impacting the lives of millions of users and have the potential to significantly reduce America’s obesity epidemic. There’s also no shortage of opinions on how this will impact the food & beverage industry, especially large snacking, confectionary and soda platforms.

Although we’re sure GLP-1’s will impact consumption patterns on the margin, consider us skeptical that they pose anywhere near an existential threat to current market participants. First of all, we believe incumbents will be able to adapt existing products or develop new ones to address evolving consumer preferences without materially impacting overall profitability. Secondly, to put a bit of a different spin on an old cliché about American shoppers, “never bet against the resiliency of the American eater!”

Snapshot of the European Food, Beverage & Agriculture M&A Deal Activity

Taking the long view – 2H 2023 deal volumes in Europe are down, but the market has been open

Number of acquisitions of European-based FB&A companies (deal value below USD 500m) & food inflation index rate from ECB

Source: MergerMarket, European Central Bank

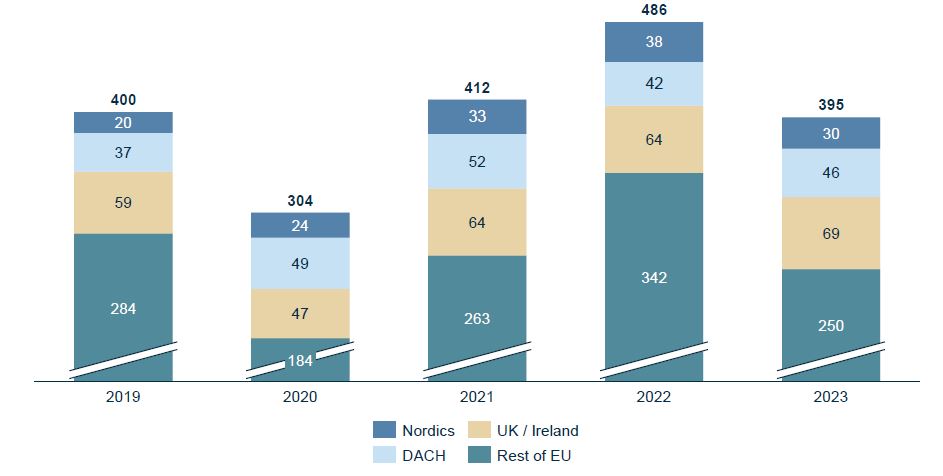

The picture varies from region to region – 2023 saw out-sized M&A activity in the UK/Ireland compared to other European regions

Number of acquisitions of European-based FB&A companies (deal value below USD500m) divided by region of target company

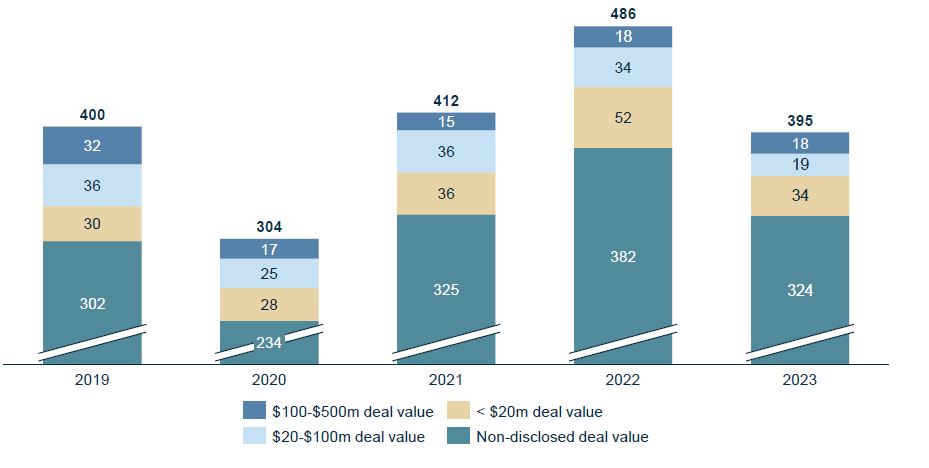

Deal activity has dropped in the mid-market, with 37 deals between $20 and $500 in deal value and a lower contribution from non-disclosed deals

Number of acquisitions in European-based FB&A companies (deal value below USD 500m), divided by deal size

Source: Mergermarket

Source: Mergermarket

Public Company Valuation and Operating Metrics

For full analysis of public company valuations and operating metrics please see the full downloadable report.

Engaging in future opportunities

Our insights reflect broader trends, and we find ourselves engaging more frequently in discussions about potential M&A activities in the food, beverage, and agriculture sectors. For many, this marks the first opportunity since 2019 to explore strategic growth without the disruptions of COVID-19 or inflationary pressures.

With a strong pipeline heading into 2024, we anticipate an uptick in M&A activity. We are eager to discuss how we can support your strategic objectives in this evolving market landscape.

You can find more information on our Consumer Team here.

Related Consumer Insights

Consumer M&A: Food, Beverage & Agriculture – Spring 2023

Consumer M&A: Active & Outdoor – Q1 2024

Consumer M&A: Outdoor & Active Lifestyle – Spring 2023

Consumer M&A: Products – Spring 2023