Industry Update: Aerospace, Defense & Government Services

“Herd” on the Street

During the first half of 2025, the D.A. Davidson | MCF International AD&GS team has attended over a dozen industry events and engaged in numerous conversations with key industry constituents across strategic and private equity acquirers. The following represents a summary of Davidson’s Bison “Herd” on the street.

Aerospace

Trump administration increases the tariff rate on steel and aluminum imports

- On April 2, 2025, what is now referred to as “Liberation Day”, Trump announced a 10% import tariff on all products for ~90 countries and imposed higher “reciprocal” tariffs on targeted geographies and industries (incremental to prior tariffs imposed)

- In early June 2025, the Trump administration increased tariffs on steel and aluminum imports from 25% (set in March 2025) to 50%; steel and aluminum represent the two largest raw material sources used in aerospace manufacturing

–The tariffs apply to imports from all countries except Russia which already faces a 200% tariff on aluminum and the United Kingdom which negotiated a 25% tariff under the

U.S. – UK Economic Prosperity Deal announced in early May 2025 - Aerospace Industries Association and Airlines for America trade groups have warned of the potential negative consequences of these rate increases including damage to the recovering aerospace supply chain, a higher volume of counterfeit parts entering the country, and a spike in airline ticket prices and shipping rates.

Boeing resumes deliveries to its Chinese customers

- Boeing resumed aircraft deliveries to its Chinese customers as the U.S. and China have eased their tariff war; the delivery of new planes to China had been on hold since April 2025 when at least three 737 MAX jets were repatriated by Boeing to the U.S.

–China currently represents ~10% of Boeing’s commercial backlog and is expected to become an increasingly important country in the aviation market

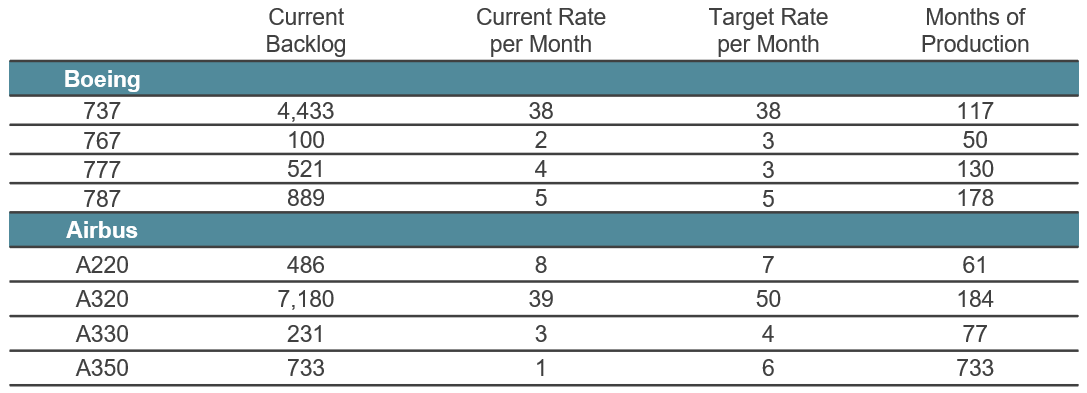

Boeing and Airbus backlogs grow amid continued production struggles

- Boeing and Airbus continue to face challenges ramping production due to persistent supply chain constraints – most notably engine shortages and structural component delays

Boeing and Airbus Backlogs and Production Rates

Sources: DACIS, Airbus, Boeing, and other publicly available resources.

2025 Paris Air Show takeaways (for the full version click here)

Davidson | MCF’s AD&GS team attended the Aerospace industry’s largest event – the 55th International Paris Air Show in June

–Searching for Smooth Air Amidst Geopolitical and Market Turbulence: Despite geopolitical tensions and the recent Air India tragedy, the world’s biggest aviation trade show was vibrant and well-attended

–Israel-Iran Conflict Felt on the Show Floor: The Israel-Iran conflict was a significant topic; the French government controversially shut down several Israeli exhibits for displaying attack weapons

–European Defense Resurgence: The show highlighted Europe’s increased defense budgets and continued dependency on U.S. defense technology amid regional conflicts and doubts about U.S. commitment to NATO; a record ~45% of exhibits at the air show were defense oriented

–Boeing Keeping a Low Profile for a Second Straight Year: Boeing had a low-key presence at the show due to the Air India crash investigation, booking its lowest Air Show purchase order total in over 12 years

–Commercial Demand Remains High: Despite Boeing’s recent challenges, commercial aerospace demand remains high with Airbus announcing significant orders and options

–Drone & eVTOL Proliferation Overshadows Traditional Rotorcraft: eVTOLs and drones were prominent, showcasing advancements in autonomous systems and the impact of the Ukraine conflict on warfare technology

–Aerial Displays – More of the Same as Legacy Platforms Shine: The aerial displays featured legacy platforms like the F-35, with the industry focusing on sustaining and adapting existing aircraft due to supply chain and budget constraints

–Creating a New “Space” for Space: The Paris Space Hub established Space as a key focus at the Air Show with notable announcements, including ESA’s agreement to build the Laser Interferometer Space Antenna and a partnership with Thales Alenia Space and Blue Origin to advance space exploration in low Earth orbit

Executive order clears path for U.S. supersonic flights

- In early June 2025, Trump signed an executive order requiring the FAA to remove restrictions on supersonic flights within U.S. airspace that have been in place for 50+ years

–While the executive order spurred optimism for commercial supersonic flight companies like Boom Supersonic; questions around affordability and sustainability remain

UK commits to investing in clean tech for air travel

- In mid-June 2025, the UK government announced a $300M+ investment in clean aviation technology aimed at accelerating the development of zero-emission flight, advanced manufacturing techniques, and aerodynamic efficiency

–The funding will be directed towards major aerospace companies like Airbus and Rolls-Royce with smaller business and academic institutions assisting with the research

Sources: DACIS, whitehouse.gov, and other publicly available resources.

Download

The full report, including Global, US Defense, Government Services and Space Market update as well as M&A activity, debt and capital markets activity, can be downloaded at the top of the page.

Contact us

If you have any questions about the report, don’t hesitate to get in touch with one of our team.

MCF deal team