Technology M&A: Supply Chain Software – Spring 2023

Industry Update

In the current market environment developing and maintaining a reliable, transparent, and agile supply chain is a key focus area across industries. In this report our Technology team, in collaboration with our colleagues from D.A. Davidson examine the need for tools and solutions to maneuver challenges caused by supply shortages of components, price inflation, and geopolitical tensions.

The report includes selected transactions from Europe, recent MCF case studies and a background on our services. The full report is available to download and highlights are noted below.

Introduction to Supply Chain Software

The demand for supply chain software solutions is driven by the need to stay agile and improve efficiency of supply chain operations. In the current market environment developing and maintaining a reliable, transparent, and agile supply chain is a key focus area across industries. There is a need for tools and solutions to maneuver challenges caused by supply shortages of components, price inflation, and geopolitical tensions. Companies across sectors are adapting solutions to the challenges they face and the complexity of the current market environment. Robust supply chain software is helping to manage and optimize sales, manufacturing, warehousing & inventory, procurement & sourcing, order tracking, freight planning and fleet management.

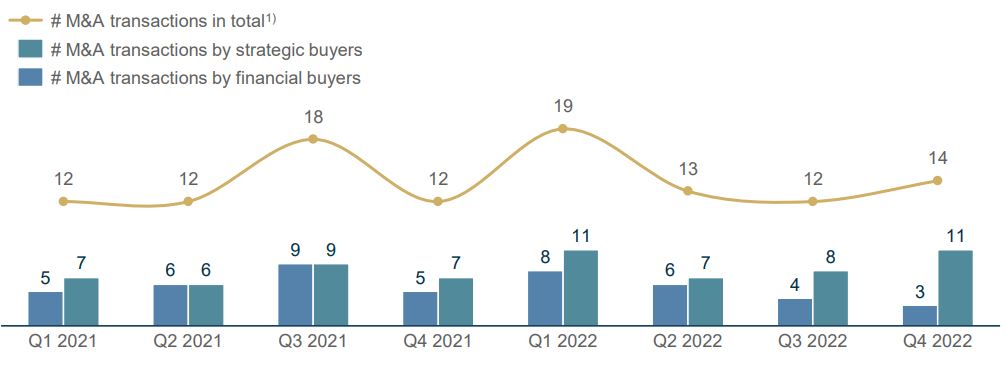

The Supply Chain Software market is maturing and consolidation is taking place, creating service providers with a broader solution offering. More than 60% of M&A activity in 2022 within the Supply Chain Software sector in Europe was executed by strategic buyers, and private equity has continued to make investments into the sector. M&A activity within the Supply Chain Software sector has proved to be resilient and sector targets attract interest from both strategic buyers and financial sponsors. Supply chain software vendors are evaluating how to continue growing, how to expand into new markets and how to complement their service offering with new solutions. M&A continues to be a key tool for reaching these objectives.

“M&A activity within the Supply Chain Software sector has proven to be resilient and sector targets attract interest from both strategic buyers and financial sponsors.”

Supply Chain Software Trends

Supply Chain Agility:

Supply chain disruptions caused by the COVID-19 pandemic and the war in Ukraine have underlined the importance of tools used to monitor and control the supply chain. In order to maneuver in a rapidly changing environment, organizations are increasingly turning to software to help them reduce the time it takes to respond to real-world events.

Automation and AI:

Supply chain organizations aim to lower costs and improve throughput and efficiency. By utilizing AI and automation software, organizations can automate manual tasks within the supply chain while making more informed, data-driven decisions.

Cloud Technology:

Cloud-based Supply Chain Software provides greater flexibility for companies in organizing supply chain operations. The trend towards investment in cloud-based software solutions is expected to continue and accelerate.

Visibility & ESG:

Maintaining end-to-end visibility of the supply chain will continue to be crucial. Supply chain organizations need software for better decision-making. Moreover, companies are facing mounting pressure to prioritize supply chain sustainability and reduce their carbon footprint.

Macro Environment:

Global M&A and funding activity has seen a decline due to economic uncertainty and increasing interest rates both in Europe and the United States. However, in Europe, Supply Chain Software transactions have remained relatively stable, emphasizing the defensive nature of business-critical software.

M&A Environment

Development of the European M&A market in the supply chain software segment

Despite a decline in valuation levels and a global downturn in M&A activity during 2022, the number of M&A transactions within the Supply Chain Software segment remained relatively stable in Europe. Strategic buyers have been at the forefront of the sector, accounting for approximately 60% of the recorded acquisitions between Q1 2021 and Q4 2022. This highlights the vital role that Supply Chain Software plays as an integral component of an organization’s operations, which cannot be disregarded even amid macroeconomic uncertainty. During the observation period (Q1 2021 – Q4 2022), Mercell, Nexxiot, and Pinja have been the most active strategic buyers in Europe – each acquiring two companies, respectively.

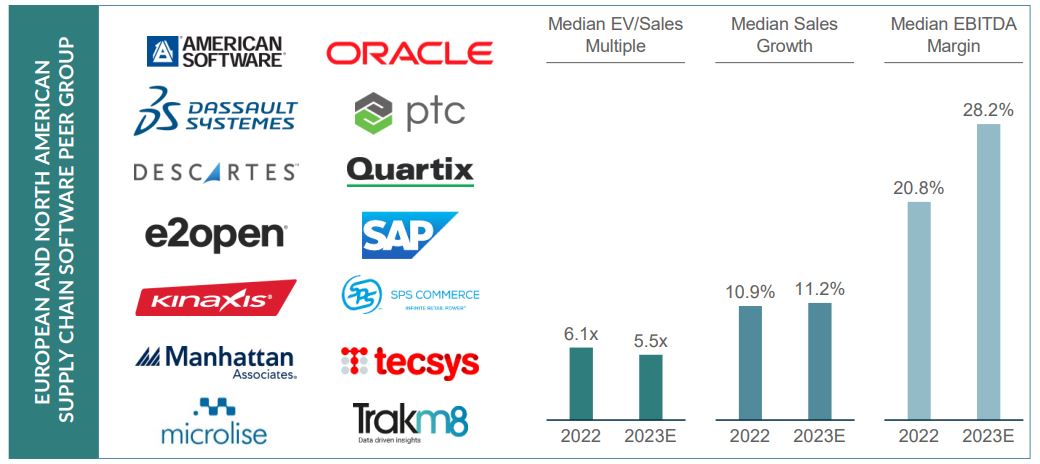

Public Valuation Environment

Public trading multiples of European & North American supply chain software companies.

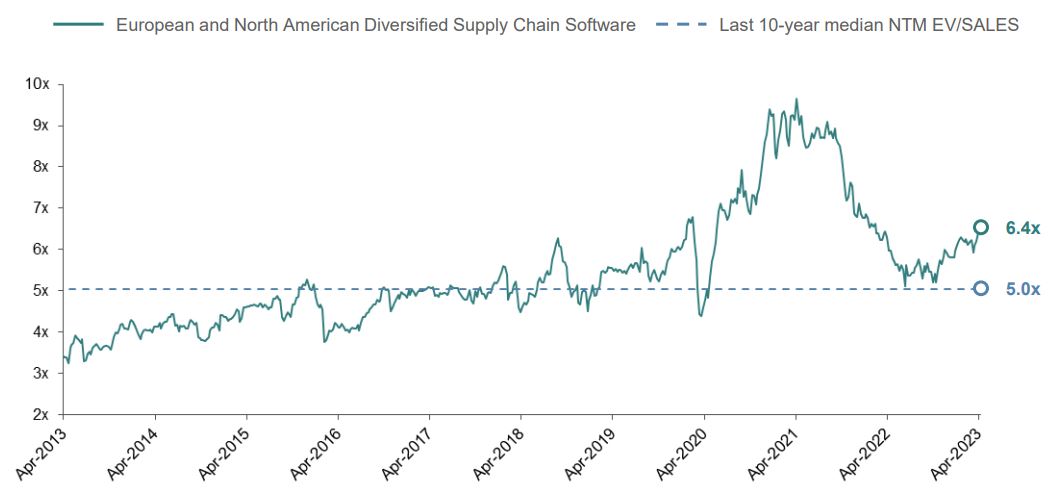

Valuation levels remain on a high level in 2023 but have decreased significantly from the highest levels of previous years. With an NTM EV/SALES multiple of 6.4x, European and North American diversified Supply Chain Software companies are still trading above the historical 10- year median of 5.0x.

NTM EV/Sales development of supply chain software companies

Source: S&P Capital IQ

Case Study | Formulate

The Deal

Formulate, a rapidly growing company in the AI and SaaS space, offers sophisticated analytics tools to retail clients. The proprietary technology enables users to optimize every phase of the campaign process, resulting in increased promotion profits and an improved customer experience. Formulate’s owners mandated MCF to advise on the sales process and find a partner who shared their vision for the dynamic company. As a result of this successful transaction, Relex and Formulate will now provide a sophisticated platform for end-to-end planning and optimization of complex retail operations.

The Buyer

Relex, the Finnish supply chain automation and optimization platform, provides end-to-end retail planning solutions to help retailers and brands reduce waste, costs, and manual work. The company was founded by three supply chain scientists in 2005 and today employs more than 1,300 people. Relex recently raised EUR 500 million from investors including Blackstone, TCV, and Summit at a EUR 5 billion valuation.

MCF’s team provided trusted advice, and their SaaS expertise was imperative in helping us find the right partner. We are delighted to have found an adviser who understands our values.”

Andreas Willgert, Co-Founder and CEO of Formulate

Get in touch

Should you have any questions about the report or wish to explore how we can assist your company with M&A-related issues, please don’t hesitate to contact our team. You can find additional insights and explore our Technology M&A services here.

The complete report includes a selection of European transactions, recent MCF case studies, and an overview of our services.

Get in touch