Building & Construction: Industry Update – Spring 2023

Soaring interest rates, supply chain challenges, labor shortages and recession concerns represent

headwinds for the building technology and construction industry. In this update, we examine how the

macro environment affects public valuations, M&A deal activity and why M&A and debt advisory services

might be more important than ever.

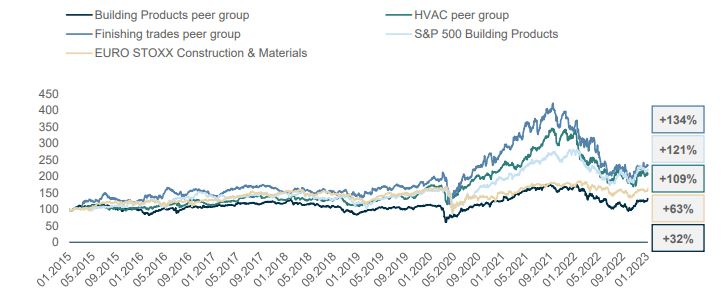

Despite macroeconomic concerns such as rapidly rising interest rates, ongoing supply chain challenges following COVID-19, the war in Ukraine, and fears of a recession, valuations in 2022 have remained surprisingly robust, particularly within the HVAC and building technology service sectors. Market drivers that are generally seen as economic concerns, like the energy crisis or the substantial investment backlog in residential buildings and public infrastructure, are paradoxically presenting more opportunities than risks for the construction industry.

Transaction activity within the building technology and construction sector has remained high, with 2022 marking the second most active year for M&A in the sector since 2009. Market consolidation is continuing, fueled by numerous succession situations, the high liquidity of large corporates, and the growing interest of private equity in energy transition and efficiency projects. Germany is witnessing the entry of new investors and consolidation concepts into the market. MCF’s extensive industry knowledge, along with our tailored M&A and debt advisory services, enable our clients to maximize value, especially in these challenging times.

Industry Trends and Drivers

Interest rate environment

Further increasing interest rates in the Euro zone will impact new building activity in the DACH region. Many private and commercial construction development companies expect to reduce their activities in the short-term.

Energy Efficiency Regulation

Electrical, heating, ventilation and insulation benefit from stricter energy efficiency regulation and subsidies for renovation programs. The EU green deal will foster energy efficient renovation of existing buildings and is complemented by local regulations.

Renovation Backlog

Germany’s public infrastructure with its high renovation backlog due to missed investments in the past shows high investment pressure in the short and medium term. Approx. 90% of residential buildings in Germany do not meet current legal requirements

Labor Shortage

The general shortage of skilled workers in Germany will have an impact on the construction industry and will be further impacted by increasing interconnection of trades and complexity of building products.

Material Prices and Supply Chain

Supply chain issues due to COVID-19 resulted in significantly rising material prices, further fueled by rising inflation. After strong price

increases in recent months, the situation has eased somewhat as first

suppliers respond to weaker demand.

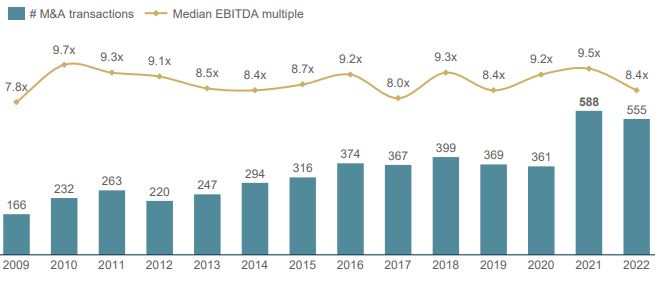

Development of the European M&A Market in the Building & Construction Sector

Despite significantly rising interest rates since the beginning of 2022, the number of M&A transactions in 2022 was close to an all-time high. While the interest rate development will impact building activity, the renovation backlog and energy regulation will drive demand from the finishing trades and M&A appetite of corporates and financial investors.

Public Valuation Environment

Public trading multiples of European building companies

Share price performance of building companies versus sector indices

Case Study: A. & H. Meyer

Sale of A. & H. Meyer to legrand

A. & H. Meyer, established over 60 years ago, is now a leading international supplier of tailor-made electrification, data, and cable management systems serving various end markets, with operations in Germany and Malaysia. The company is celebrated for its exceptional product quality, underscored by global sales approvals and its significant value-added in-house production capabilities. Headquartered in Dörentrup, Germany, A. & H. Meyer employs approximately 190 staff.

The Deal

In this transaction our industrial’s team orchestrated a structured auction process, reaching out to potential buyers globally. Beyond preparing the necessary process documents, our team provided comprehensive support to A. & H. Meyer throughout the transaction, especially during the due diligence phase. We advised on and negotiated the commercial terms of the transaction and assisted the sellers in reaching an agreement and finalizing the Sale and Purchase Agreement (SPA). Our deep experience in the industrial sector, combined with a thorough understanding of German mid-sized companies and their various stakeholders, played a crucial role in facilitating a successful transaction.

“The excellent support and valuable expertise of MCF was a key success factor to accomplish an optimum succession for my employees. MCF has been a trusted partner throughout the transaction process, and I am very grateful for their support.”

Horst Meyer, CEO of A. & H. Meyer

Case Study: MÜPRO

Acquisition of MÜPRO by IK Partners

MÜPRO is a specialty manufacturer and distributor based in Germany, known for its advanced pipe fixing technology for technical building equipment, as well as sanitary, heating, ventilation, and air conditioning (HVAC) applications.

IK Partners, a European private equity firm, concentrates its investments in the Benelux, DACH (Germany, Austria, and Switzerland), France, the Nordics, and the UK. Since its inception in 1989, IK Partners has successfully raised over €14 billion in capital and invested in more than 160 European companies.

The Deal

Our Industrial team took charge of the entire buy-side process, encompassing

- target screening,

- purchase price determination,

- and the preparation of crucial decision-making documents.

Our proficiency in the building technology segment, coupled with the involvement of senior advisers and strategic market intelligence, played a pivotal role in facilitating the deal. We advised on and negotiated the commercial terms of the transaction, providing support to the sellers in reaching an agreement and finalizing the Sale and Purchase Agreement (SPA).

Get in touch