Technology M&A: CE CX Software – Q1 2024

Insights Report

The CE/CX Software Insights Report is a resource for founders, CEOs, and investors in the CE/CX space.

It offers comprehensive analysis and insights into market consolidation, financing and valuation. The report is in two sections. The first provides a detailed examination of market dynamics, segmentation and consolidation trends. The second section offers private and public valuation insights across the CE/CX landscape. For further details or to discuss the implications of these findings, please don’t hesitate to contact our team.

CE CX takeaways from Q4 include:

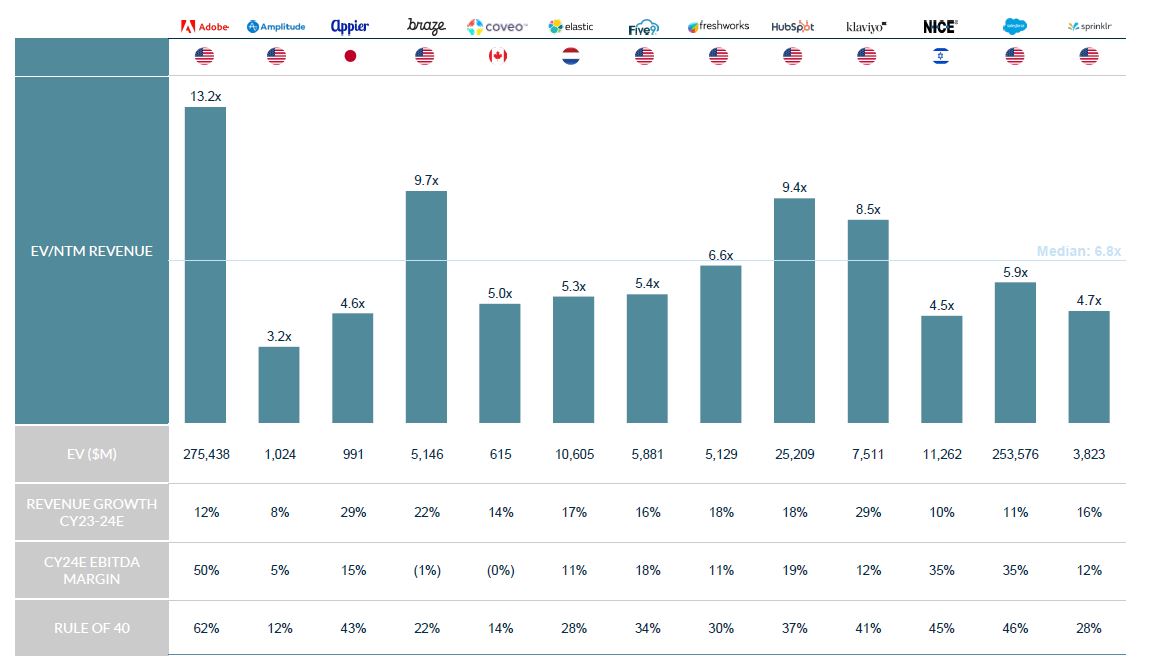

- Publicly listed CX / CE software companies are trading at a median of 6.8x revenue multiple

- Achieving the Rule of 40, reflecting capital-efficient growth, is a key valuation determinant.

- Of all the companies achieving the Rule of 40 or more, growth-focused companies have a median revenue of 14.7x compared to profit-focused companies which have a median revenue of 8.1x. Growth is still the dominant driver, even in the current market.

Key topics surrounding the CE/CX sector

- M&A consolidation – surge in M&A activity supported by increased sector interest from well-funded PE sponsors to create a market-leading ‘super solution’.

- Marco-economic headwinds – Reduced marketing budgets to focus on core operations and preserve cash in the face of economic uncertainty.

- Personalisation critical – Personalisation solutions are a critical capability and a priority investment vs. other marketing tools. Low likelihood of businesses developing in-house CE/CX solutions.

- CDP/Orchestration – The next wave of growth will be driven by the integration of AI while large, sophisticated businesses uptake CDP/orchestration to maintain their competitive edge

- Integrated suite vs. best of breed – The trend towards integrated product suites; however, large and sophisticated customers prefer best-of-breed solutions that are easy to use for increasingly simplified use cases, e.g., reducing friction

- Share of voice – Large CE/CX software vendors able to collect data across wide and diverse range of touchpoints have an advantage over smaller peers

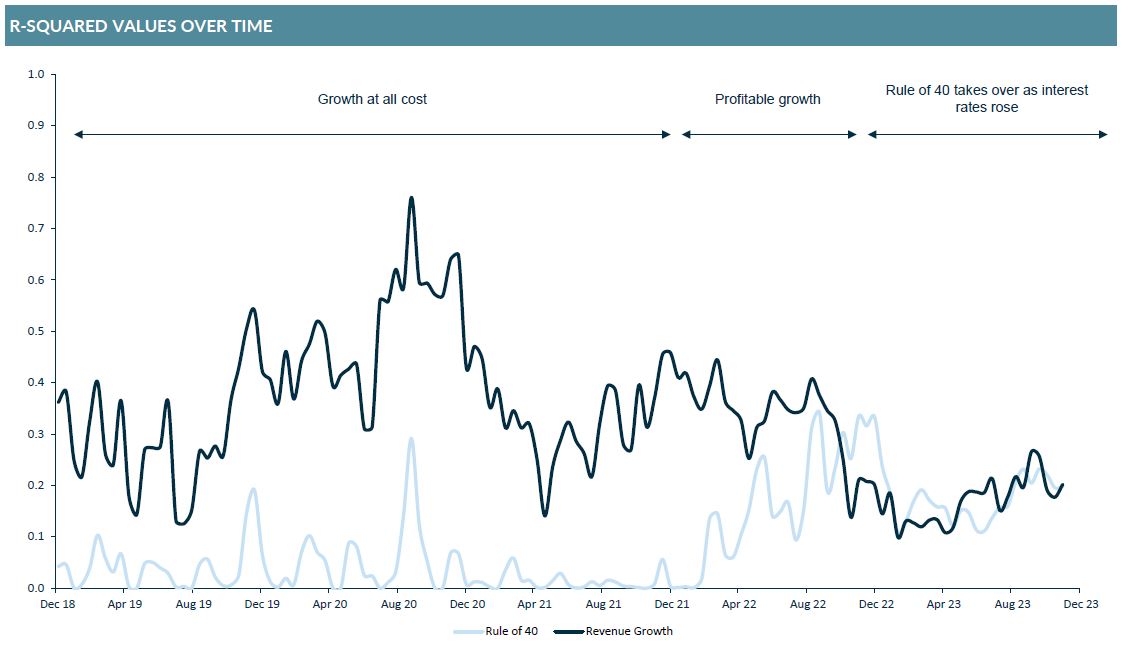

Increasing relevance of rule of 40 as growth slows down…

Whereas growth was the primary driver of valuation during COVID, the combination of profitability and growth (i.e. “profitable growth”) has taken over (Rule of 40)

Source: Capital IQ as of December 31, 2023

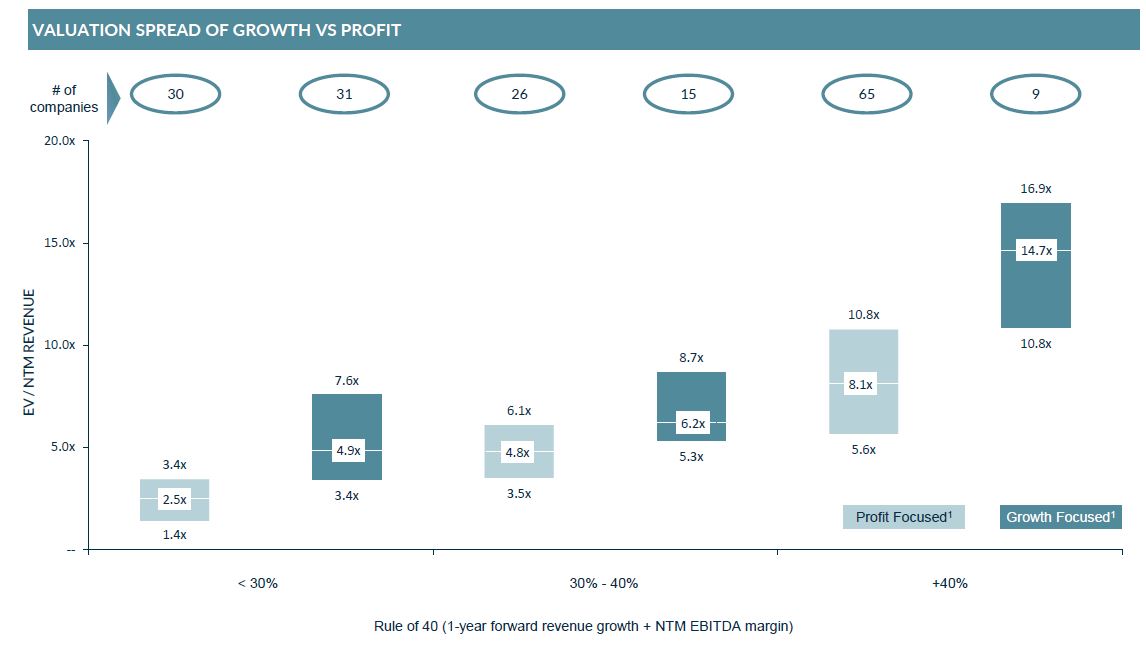

Although growth remains the dominant value driver over profit

Investors now look at a combination of profit and growth to determine valuation, while growth remains the more important constituent in the Rule of 40 rather than profitability

Source: CapitalIQ as of December 31, 2023

Notes: 1) Growth focused means that the growth component within the Rule of 40 is larger than the profit component and vice versa for profit focused

CE/CX Software listed peer valuation metrics

Publicly-listed CE/CX software companies currently trade at a median EV/NTM revenue multiple of 6.8x

Source: S&P Capital IQ as of 01-December 2023

For selected transactions in the CE/CX space and relevant financings, please see our full report.

Technology M&A Case Study | Zoovu

Zoovu raised $169m in its Series C round led by FTV Capital

Company Overview

- Founded in 2006, Zoovu is a digital conversation platform for enterprise that delivers rich, contextual, and personalised content enabling businesses to improve their sales and services.

- With 1bn+ of interactions per month in 135+ languages, Zoovu helps its 300+ customers around the world to increase.

Transaction Overview

- In June 2022, FTV Capital, a New York-based growth equity fund, invested $169m in the Series C fundraising

- Zoovu has the ambition to scale the business quicker and further, notably in the USA, through a combination of new capital and the fund’s expertise in developing fast-growing SaaS businesses.

- FTV Capital was chosen as the right partner because of its attractive valuation, speed of execution, compelling management terms, and offering Zoovu a unique opportunity to accelerate its deployment in the US.

Advisor role

- Input into Zoovu’s M&A strategy—identifying and interacting with a number of highly relevant targets.

- Extensive access to financial sponsors both in US and Europe.

- Sector knowledge to deliver the key financial metrics in the most relevant and compelling fashion for investors.

Key Takeaways

- Assistance in identifying and interacting with highly relevant acquisition targets.

- In-depth sector knowledge and bespoke advice on M&A process as well as financing round.

- Wide US and European network to attract multiple bidders and achieve a premium valuation.

Note: Transaction advised by D.A. Davidson MCF International Partner prior to joining the firm

Get in touch

If you found the insights in this CE/CX report engaging or wish to delve deeper into understanding how M&A activities can bolster your business, we encourage you to reach out. Our team is on hand to discuss the nuances of the report or explore strategic opportunities tailored to your specific needs. Don’t hesitate to get in touch and take the next step in advancing your business objectives.

You can find additional insights and explore our Technology M&A services here.