Technology M&A: Cybersecurity – Spring 2023

Industry Update

Cybersecurity and infrastructure software is a core competency of our technology practice. Our recent relevant references demonstrate the domain expertise, global reach and real time insights we bring to our clients.

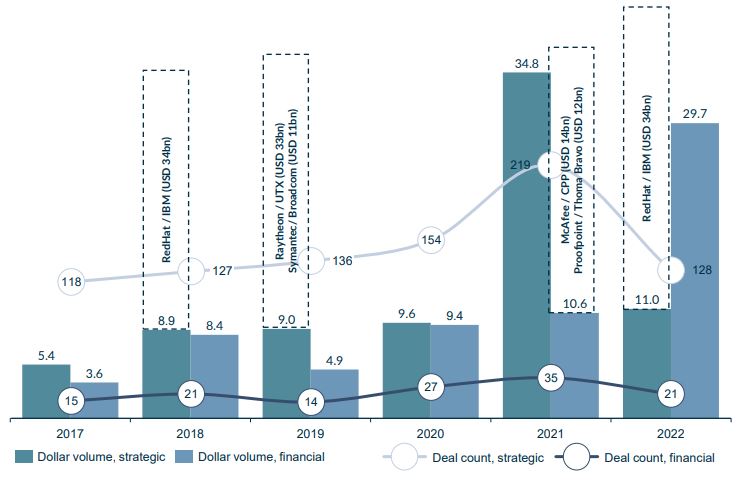

Cybersecurity M&A Activity has been resilient during market slow down

Strong market activity continues into 2023 – Cybersecurity M&A deal count and dollar volume (USD, bn): 2017 to 2022

- M&A market activity in the cybersecurity space has been very resilient during the general 2022 slow down in software market transaction activity, reflecting robust tailwinds across the vertical both on top line growth and margin performance.

- Financial sponsors are continuing to back large vendors in the space with significant capital, alongside continued interest from strategic acquirers.

- These figures are backed up by D.A. Davidson MCF International dialogues with key market players – cybersecurity is a clear priority area for M&A as the broader software M&A market recalibrates both in terms of valuation levels and activity.

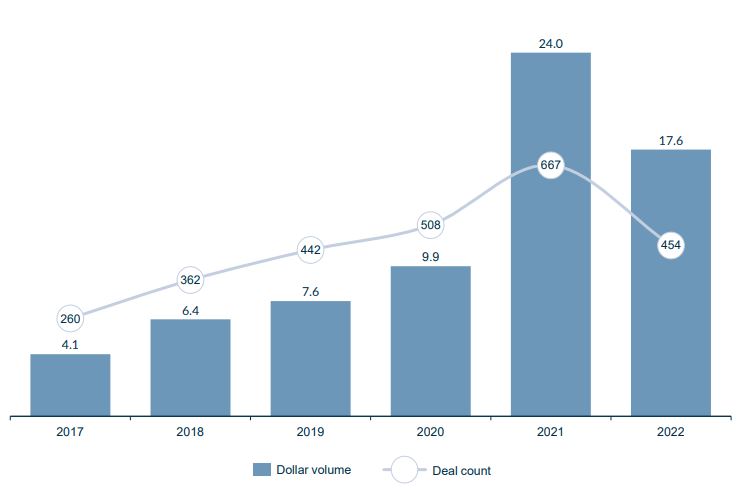

Venture Capital continues to flow into cybersecurity space

2021 and 2022 marked record funding years – Cybersecurity fundraising deal count and dollar volume (USD, bn): 2017 to 2022

- 2022 was the second largest year on record for cybersecurity fundraising following a monumental 2021.

- There has been a significant increase in the median raise amount (2022: USD 16.5m) and post-money valuation (2022: USD 35.0m), up by 103% and 29% respectively since 2020.

- Fundraising activity has particularly concentrated in the early stage (Series A to Series C) market, with USD 5.6bn invested in emerging companies.

Case Study | Cybersecurity

D.A. Davidson MCF International acted as financial adviser to Tutus Data on its sale to Formica Capital-backed C-Resiliens, a new Nordic leader in cyber, encryption, and network security.

The Seller

Tutus Data, founded in 1992, is Sweden’s leading encryption and network security company, providing high-quality network solutions for use in military, government, and corporate IT applications. Tutus is the main supplier of government-approved and certified IT-security products in Sweden, with all products having been approved at the restricted/restraint classification level on the EU and national levels.

The Buyer

C-Resiliens is a cyber security group founded in 2022, with the vision to eliminate society’s digital vulnerability through investments in new innovations. The company focuses on next-generation turn-key secure communications solutions for defense, public sector, and other businesses and organizations that are critical to society in Sweden and in the EU.

Tutus has had a very strong development over recent years and we see a clear increase in interest in our services. We will continue as an independent part of C-Resiliens and at the same time have opportunities to expand the business. It is absolutely the right time to switch up a gear, and we now have the opportunity to do so thanks to C-Resiliens’s resources and expertise.

Jens Bohlin, CEO of Tutus Data

The D.A. Davidson Technology Practice

The D.A. Davidson MCF International brand is a strategic partnership between D.A. Davidson and MCF Corporate Finance. Together, we offer clients unparalleled access to a transatlantic M&A and debt advisory platform. Our technology practice consists of 50+ investment bankers working across 15 offices in Europe and North America. We collectively advised on 44 tech transactions during 2022. Together, we work to provide bulge bracket capabilities and boutique focus to mid-market clients. Cybersecurity and infrastructure software is a core competency of our technology practice. Our recent relevant references demonstrate the domain expertise, global reach and real-time insights we bring to our clients.

Find more information on our Technology page.