Technology M&A: HR Tech – Spring 2023

Industry Update

Our Technology team have a bullish view on the HR Tech market despite the challenging deal-making environment.

Innovative HR Tech solutions to help pressured organisations

- As we step into the year 2023, organisations are confronted with unprecedented challenges, as the pandemic has left a lasting impact on human resource management, while the economic climate and intensely competitive labour market continue to exert pressure on managers.

- To help organisations succeed in this environment, there are several innovative HR Tech solutions which remain vital and benefit from increased attention, whereas certain solutions may be at risk due to the need of cost trimmings brought on by harsher macroeconomic conditions.

Scarcity of talent increases focus on strategic HR

- The already scarce talent market has been further exacerbated by inflationary pressures, resulting in an increase in talent retention issues, with more than 40% of the global workforce considering leaving their current jobs.

- To address this situation, HR leaders must carefully examine their compensation strategy and implement measures to increase employee retention, turning attention towards Strategic HR Tech solutions that were previously regarded as nice-to-haves.

- We anticipate a persistent emphasis on scalability and data utilisation, which combined with ease of use will be key differentiator.

Deal Activity expected to begin to pick up in the second half of 2023

- In 2022, there was an overall slowdown in activity, resulting in a significant drop in valuation, which continued in the beginning of 2023 as sponsor-driven transaction volumes were down 34% in Q1, and fundraising activity was down 44% during the same period.

- On the bright side, strategic M&A activity is still strong as the number of HR Tech transactions in the US and Europe are back at the same level as in Q1 2022, showing that strategic acquirers are seizing the opportunity to add product tuck-ins to a fairer market value.

- Despite the expectation of a slower Q2 2023, D.A. Davidson MCF International is optimistic about the HR Tech market where we anticipate transaction activity to pick up in H2 2023, particularly in H1 2024, owing to the interest in funding product innovation and the continued strategic importance of creating best-in-class integrated platform solutions.

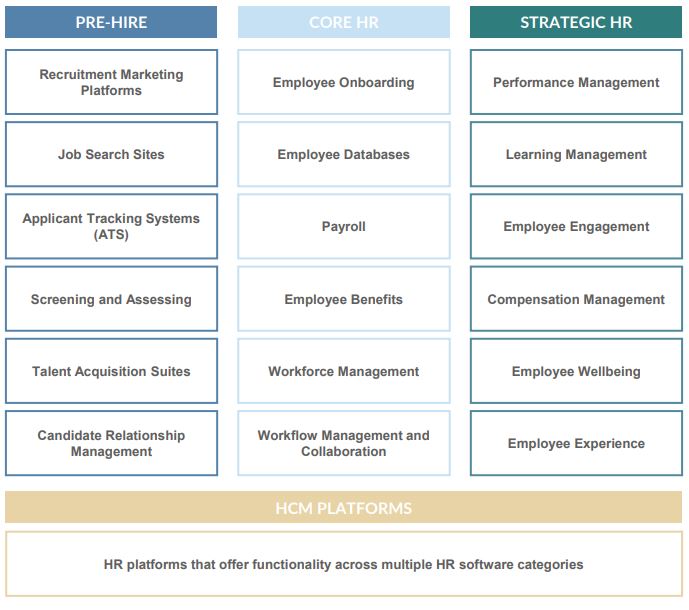

The Evolving HR Tech Taxonomy

Accelerated innovation contributes to a quickly evolving HR Tech taxonomy with heightened focus on strategic HR

Future of work trends 2023

Quiet hiring replacing quiet quitting

HR leaders are likely to adopt the practice of quiet hiring, which involves acquiring new skills without adding new full-time employees. This approach stands in contrast to the recent viral trend of quiet quitting, wherein organisations retain their employees but lose their valuable skills.

Hybrid flexibility at the front line

Since hybrid work is now a permanent feature for desk-based employees, it has also reached frontline workers in various industries like healthcare and manufacturing. The top role attractors in this segment are work schedule control, paid leave, and work schedule stability.

Need for upskilling and training

The demands of today’s working environment have heightened the need for training and upskilling at all levels in the organisation. Management skills are under pressure due to employee expectations and need to implement hybrid work strategies, whereas Gen Z has missed out on developing soft skills during the pandemic.

Healing pandemic trauma

The societal, economic and political turbulence of recent times have resulted in numerous individuals experiencing mental health challenges. This can lead to under-performance, raising the importance for employers to view their employees as complete individuals and implement tools to promote sustainable performance.

The role of AI

The growing utilisation of emerging technologies, such as AI and machine learning, in hiring processes and data collection on employees raises concerns on algorithmic bias and privacy boundaries. This puts pressure on organisations to become more transparent about their use of data.

HR Tech Market Outlook

Continued interest and capital deployed in growth areas creates bullish view on the future of the HR tech market.

Post-COVID funding activity spurred innovation and product development

- The surge in HR Tech investments, with more than USD 22bn invested in the market during 2021 and 2022, has allowed HR Tech companies to secure the necessary funds to grow and innovate.

- In the long term, these innovations will transform how companies manage talent. However, in the short run there is a confusion in the market, leading to a need for coordination across the value chain as HR Tech leaders increasingly look for integrated solutions.

Increased importance of strategic HR solutions focused on employee engagement to aid employee retention

- Strategic HR Tech solutions that prioritise employee engagement and wellbeing are growing in importance for organisations as they confront talent shortages and a global workforce where over 40% of employees consider leaving their jobs.

- In addition to improved retention rates, Strategic HR Tech solutions provide opportunities to prevent costs associated with sick leaves and under-performance due to health challenges.

Increasing number of HR Tech companies at scale expected to spur market activity over the coming years

- The high investment activity within the HR Tech space has created a landscape with many companies at scale. Over the coming years, many of these companies will evaluate their growth and strategic options, which is expected to drive Strategic M&A activity.

- US strategic acquirers, which have been more passive in the past 12 months, already in Q1 2023 indicated an increased acquisition appetite and are expected to continue to drive activity as they are looking for best-of-breed product tuck-ins to expand capabilities.

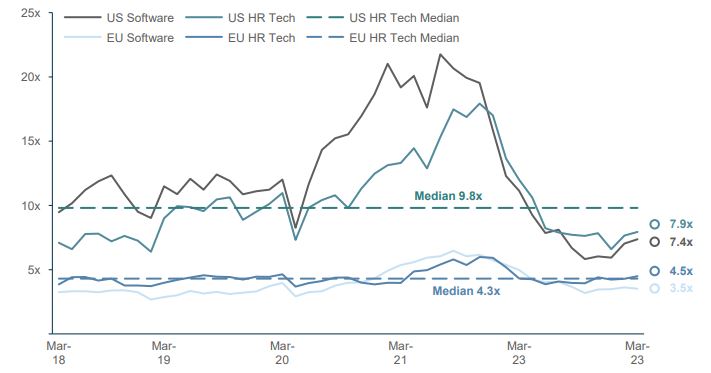

Public Valuation Environment

US and European HR Tech companies are trading higher than software indexes

LTM EV/Revenue development of HR Tech and Software Tech companies

- Over the past twelve months, HR Tech companies have been valued higher than their respective software indices, with the European group currently trading above the five-year median at 4.5x.

- As the market has shifted its focus towards profitability, the gap between high-growth and low-growth software companies has narrowed. This trend is also evident when comparing US HR Tech companies, historically known for higher growth rates, with European HR Tech companies.

M&A Environment

PE drives activity within core HR whereas VC is more focused on strategic HR solutions

- Despite a decline in valuation levels and a global downturn in M&A activity during 2022, the HR Tech deal-making stayed at healthy levels in 2022

- As we move into 2023, the M&A environment has become less confident, with financial sponsor activity falling by 34% compared to Q1 2022 and fundraising activity declining by 44%

- Looking at the deal taxonomy in Q1 2023, five out of ten of the largest deals have been within Strategic HR, reflecting the trend of increased focus on employee engagement and learning management.

For more information on financial sponsor activity in 2023 please view the full report.

Get in touch

If you have any questions or would like to discuss how these findings impact your business please get in touch with one of our team.

You can find additional insights and explore our Technology M&A services here.