MCF advised CapMan on the sale of Malte Månson to Accent Equity

CapMan Buyout has reached an agreement to sell its shares in Malte Månson, the largest independent service and repair provider for commercial vehicles in Sweden, to Accent Equity. The transaction will facilitate Malte Månson’s continued growth journey together with a new experienced partner and owner.

MCF supported CapMan in reviewing the options and ultimately finding the right partner for Malte Månson’s continued journey. The transaction adds to MCF’s record in helping well-established, PE-owned companies to maximise their valuation through sector expertise and consistent support throughout the engagement.

“We are very happy that MCF has facilitated a deal where Accent Equity is becoming our new majority owner. MCF has been a valued partner from the beginning, and we are extremely grateful for the guidance, support and the commitment from the whole MCF team we have received to facilitate this deal.” – Staffan Lindewald, CEO Malte Månson

“MCF has been an excellent adviser to us in the divestment of Malte Månson. Their engagement, transaction experience and industry knowledge ensured a successful outcome. We are also very happy with the professionalism and hands-on support that MCF has provided throughout the process.”

The Deal

Accent Equity has since 1994 invested in private Nordic companies where a new partner or owner can serve as a catalyst. Considering Malte Månson’s market leading position, exceptionally satisfied customers, and strong company culture, allows Accent Equity to draw on the Company’s strengths and continue its expansion.

The Target

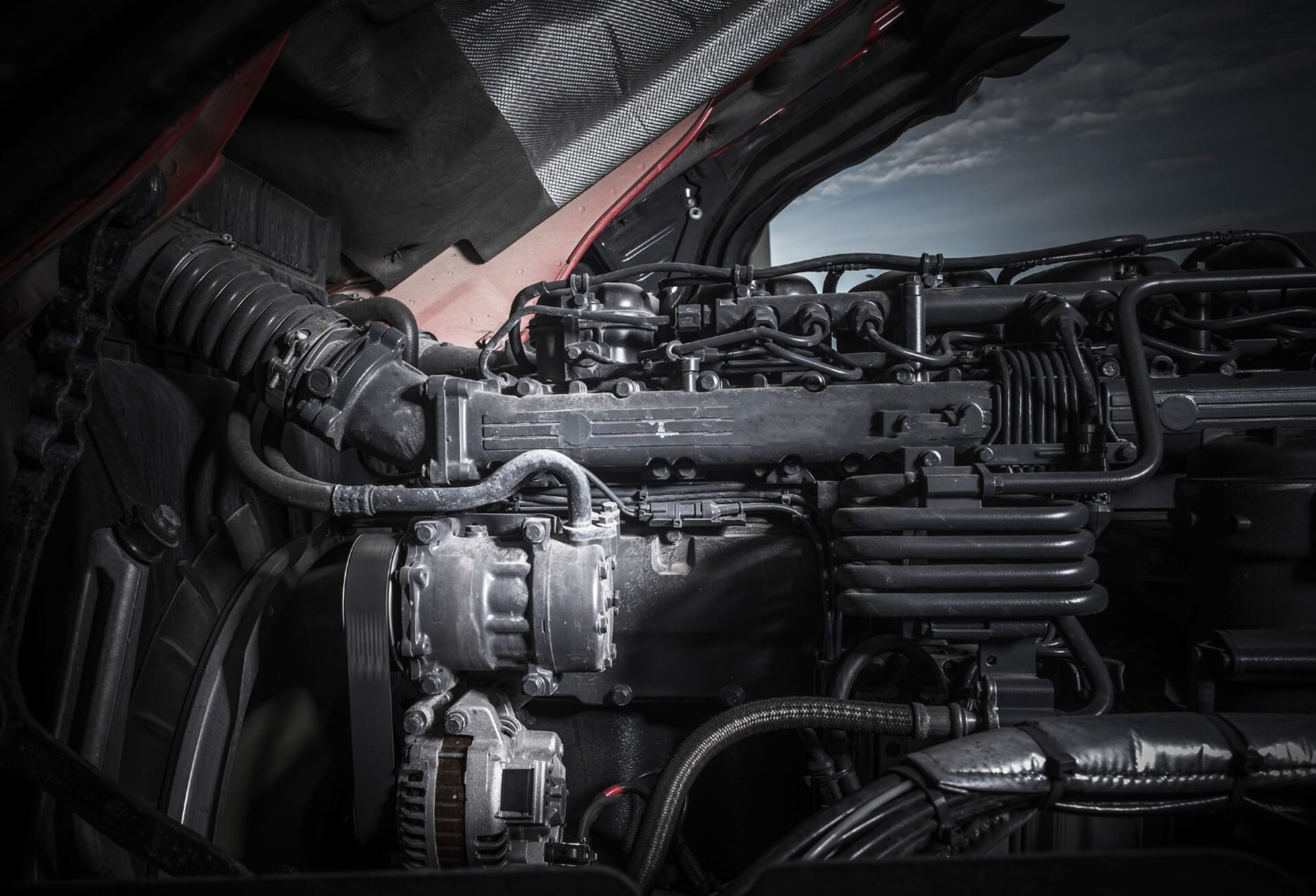

Founded in 1918, Malte Månson is the leading independent workshop chain for commercial vehicles in Sweden. The Company operates 17 workshops across the country and serves all kinds of commercial vehicles including being authorised for MAN, DAF, Iveco and Mercedes. In 2022 Malte Månson employed c. 180 FTEs and generated sales of SEK 360m.

About CapMan

CapMan is a Nordic private asset expert experienced in implementing growth strategies and building successful organisations. CapMan’s Buyout fund, in which Malte Månson was a part of, invests in unlisted Nordic companies with a winning culture and passionate entrepreneurs.

About Accent Equity

Accent Equity is a Nordic Private Equity group with extensive experience of serving as a catalyst for growth in mature companies. Accent Equity is focused on Mid and Small cap investments in companies with head offices in the Nordic region.

“MCF has been an excellent adviser to us in the divestment of Malte Månson. Their engagement, transaction experience and industry knowledge ensured a successful outcome. We are also very happy with the professionalism and hands-on support that MCF has provided throughout the process.”

MCF deal team