Norvestor sells Johnson Metall Finland to Sacotec

Norvestor IV L.P., advised by Norvestor Equity (“Norvestor”), a leading Nordic private equity firm, has fully divested its stake in Oy Johnson Metall Ab (“Johnson Metall Finland”), a Finnish market leader in manufacturing bronze bearings, to Finnish family-owned industrial group Sacotec Invest Oy (“Sacotec”). MCF acted as lead adviser to Norvestor in this transaction, which yet again proves MCF’s ability to successfully execute cross-border Nordic deals with long-term clients. Following the divestment of Robust in May this year, this transaction represents MCF’s 2nd successful mandate for Norvestor.

“MCF proved both their cross-border deal capabilities and specific industry expertise in a solution-oriented manner in every stage of the process. Overall, MCF’s contribution was instrumental in producing a satisfying outcome for all parties involved.”

The Deal

With Norvestor’s support, Johnson Metall Finland invested in premises and machine technology, enabling the company to reinforce its position as Nordic market leader in bronze products, creating long-term and trust-based relationships with its customers.

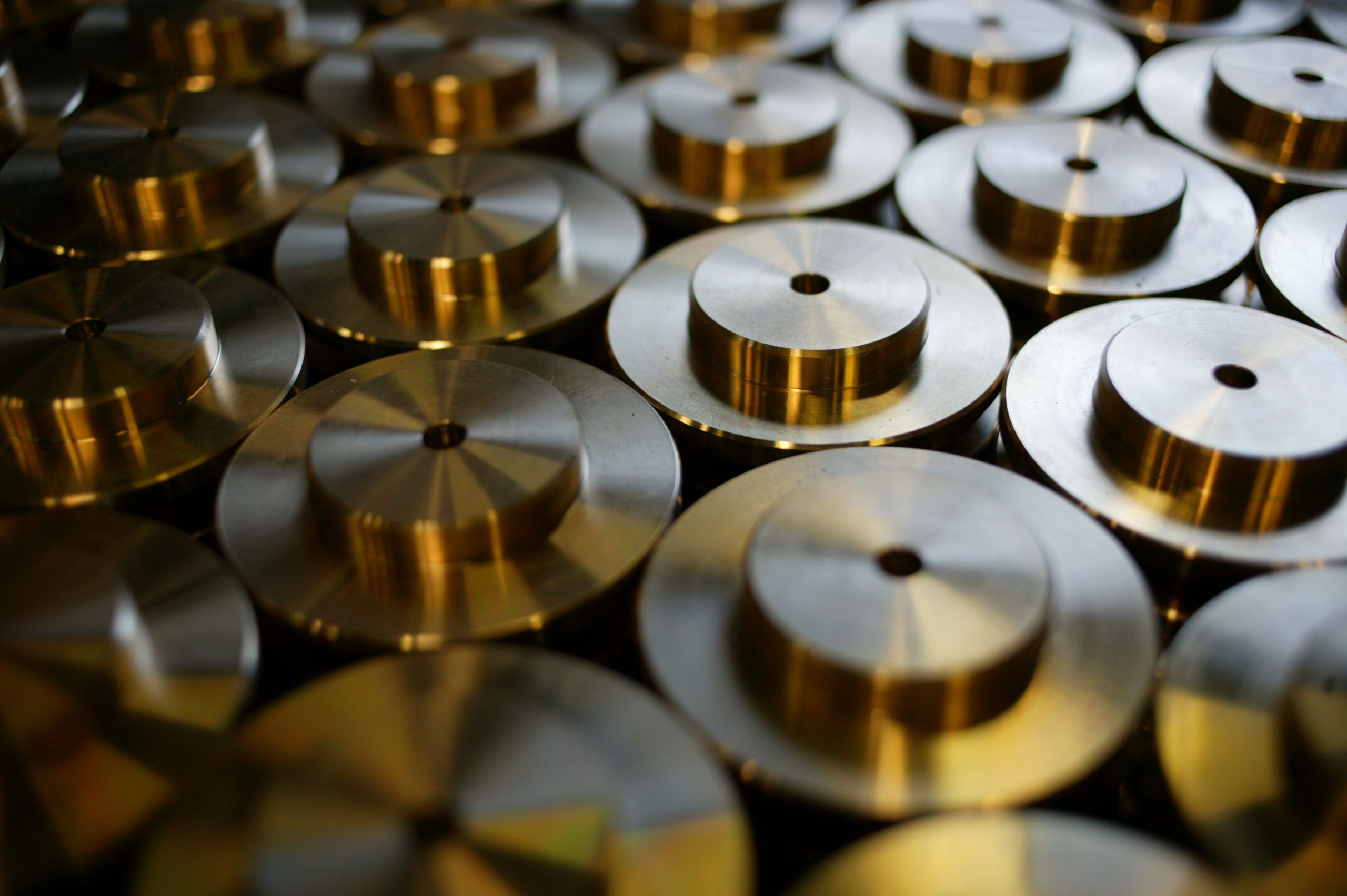

Sacotec is a Finnish family-owned industrial group that mainly operates within steel casting and other industrial activities. The acquisition of Johnson Metall Finland will enable the company to grow its operations and distribution network in accordance with its long-term strategic objective, as well as to further strengthen the company’s position in the precision casting market.

The Target

Johnson Metall Finland, formerly Messukylän Metallivalimo, was founded in 1944. Since the acquisition by Johnson Metall AB in 1970, the company has established itself as the Finnish market leader in manufacturing bronze bearings. Offering includes a full range of bronze components, serving customers with finished machined bronze components, casting goods, and traded special alloys and bearings.

About Norvestor

Norvestor is a well-established Nordic private equity firm with a track record of more than 25 years, and operates from their offices in Oslo, Stockholm, Helsinki and Luxembourg. Norvestor funds typically invest in medium-sized Nordic companies, with revenues in the EUR 25-250 m range and aims to accelerate growth and create sustainable profitability by improved strategic positioning.

“MCF proved both their cross-border deal capabilities and specific industry expertise in a solution-oriented manner in every stage of the process. Overall, MCF’s contribution was instrumental in producing a satisfying outcome for all parties involved.”

MCF deal team